Fire Sale or Future Ash?

Welcome to the Schmoozeletter Blog. Your source for weekly water cooler wisecracks from the world of finance. If you have an opinion different than mine or a topic you want to hear about, let me know!

This week, we’re talking about:

Fire Sale or Future Ash?

Ooooh baby, we got a fire sale this week!

Tons of amazing assets on discount.

Come on down to the market emporium and scoop up some high-quality compounders for long-term holds.

Do we have deals a plenty or what?

But don’t be fooled.

Not everything you see is a fiery, first-rate, future-proof, fast-growing, fundamentally strong, frictionless flagship holding to add to your portfolio.

Some things will get you burnt.

So let’s play everyone’s favorite Schmoozeletter game:

Fire Sale or Future Ash?

The big theme of the week was:

AI spending fears.

This is nothing new. We’ve heard of AI spending being out of control in the past.

Ty Lue could never.

So is all this sell-off justified? Should we be worried about the hundreds of billions in spending this year planned by big tech? Well, let’s go case by case.

First up:

Microsoft

Fire Sale or Future Ash?

MSFT just had earnings and they crushed it. They beat on revenue. They beat on earnings per share.

Revenue was up 17%.

Operating Income was up 21%.

Cloud revenue (the scary AI stuff investors are worried about) was up 29%.

And yet:

A “bust,” says Business Insider.

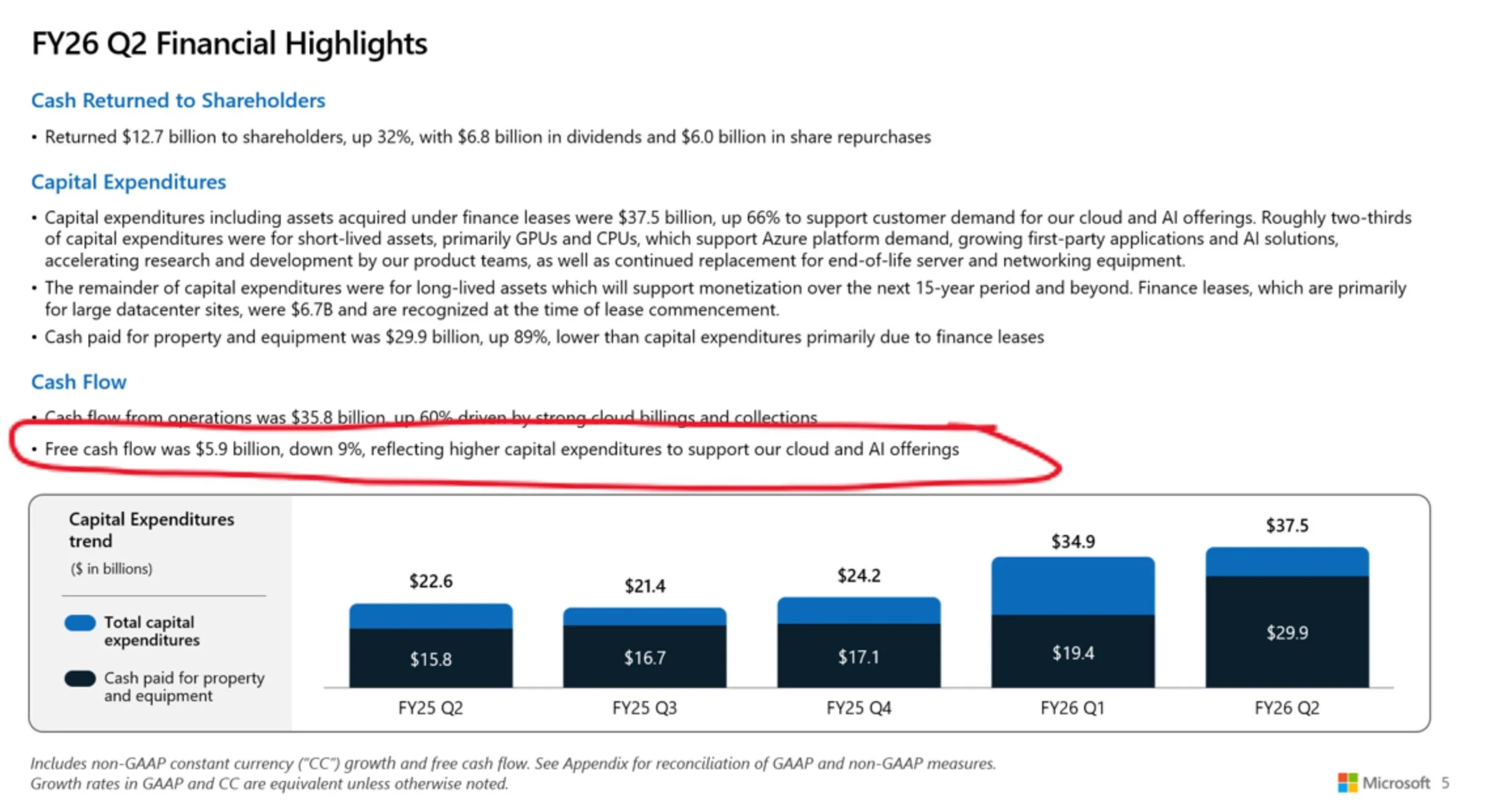

Wall Street sure didn’t like this part:

Or when they said we’ll be spending even more next year.

But here is why:

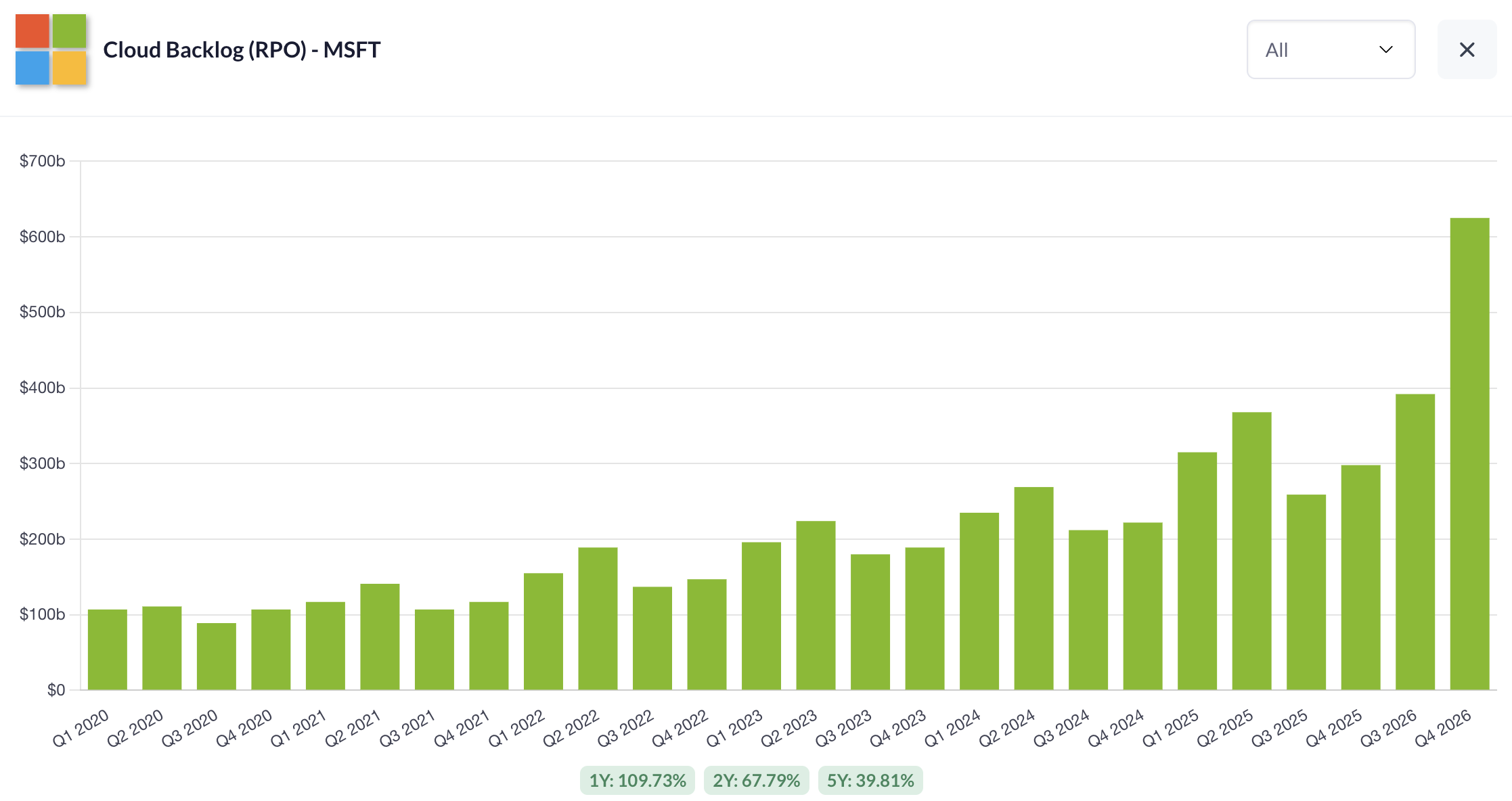

They’ve got a massive backlog. The demand is there. Investing in profitable projects is a good thing.

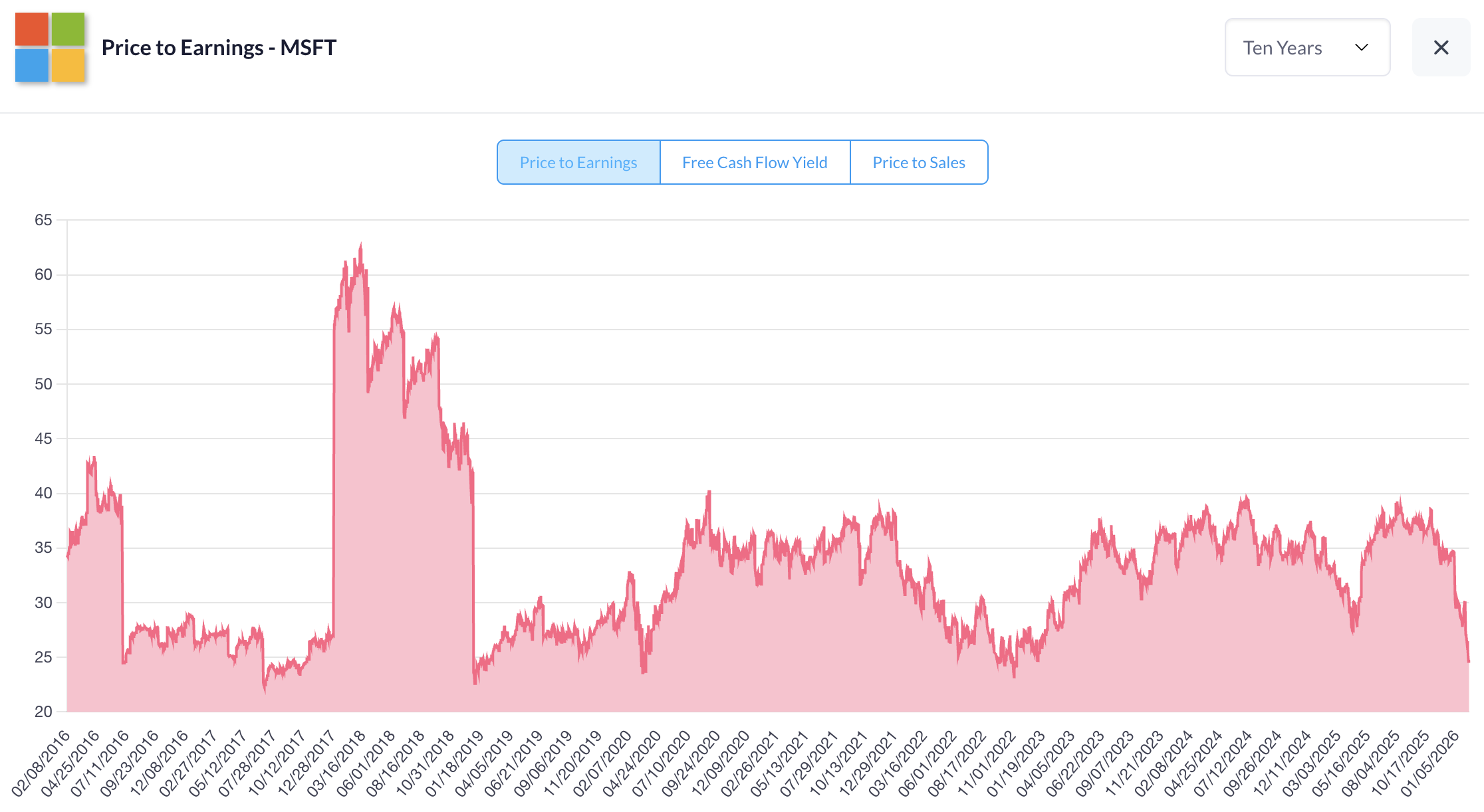

And MSFT stock is now down to one of the cheapest valuations it’s been at in the last decade.

(Lower is better if you are looking to buy.)

MSFT has been the fattest company in the market for a while now.

Official ruling:

Fire Sale!

Next up:

Amazon

Fire Sale or Future Ash?

AMZN just had earnings and they crushed it. They beat on revenue. They missed on earnings per share by literally one penny.

Revenue was up 14%.

Operating Income was up 18%.

AWS revenue (the scary AI stuff investors are worried about) was up 24%.

And yet:

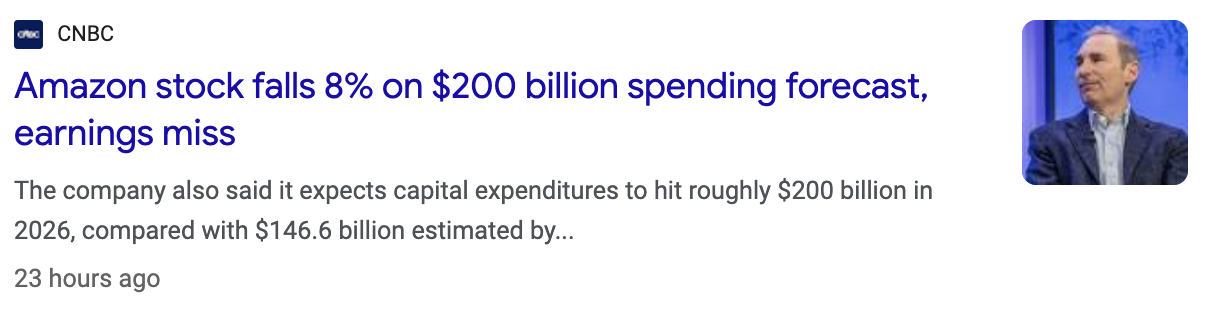

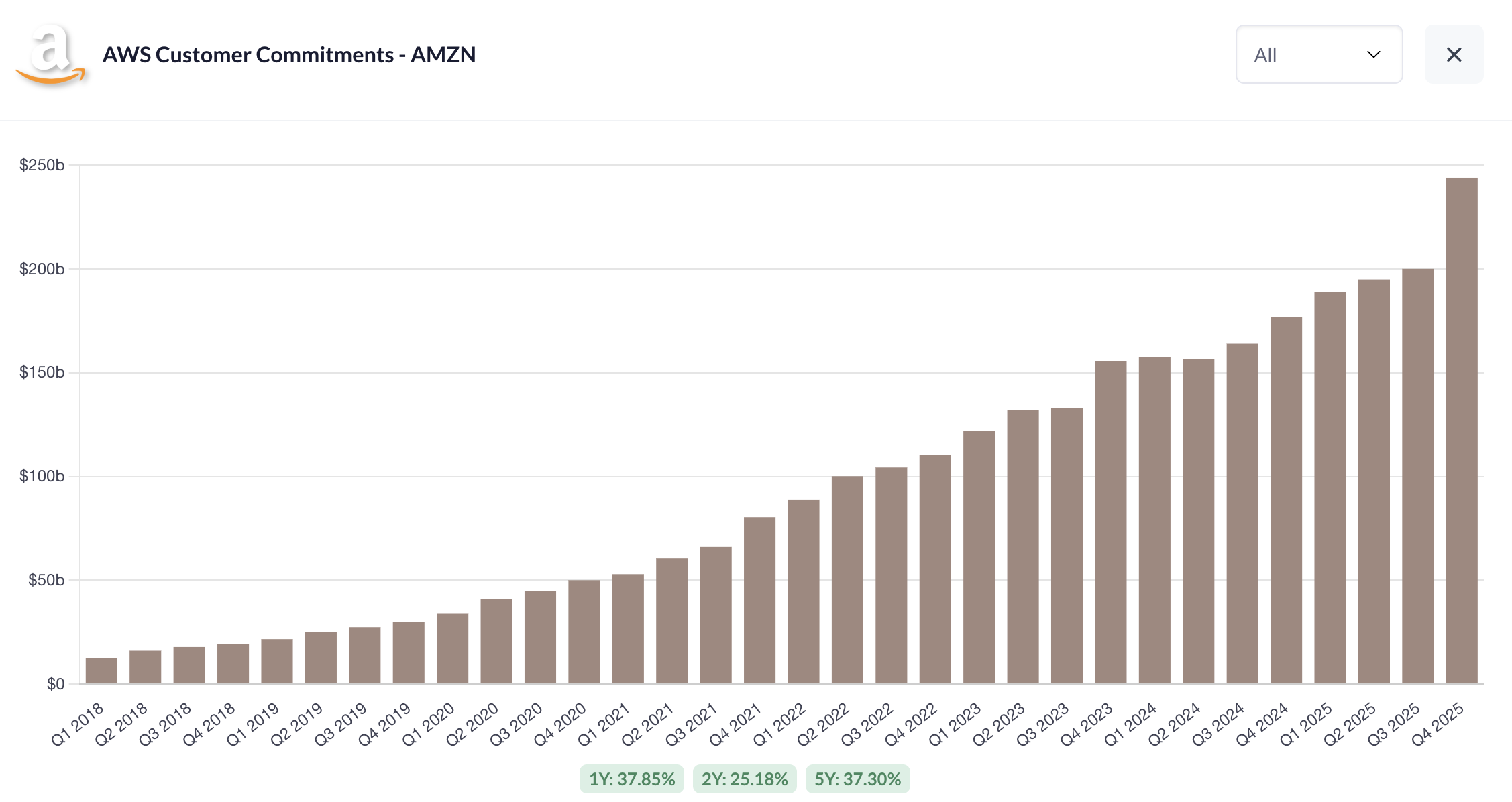

$200 billion? Seems like a lot.

But how about those customer commitments?

Massive. The demand is there. Investing in profitable projects is a good thing.

Would you like to bet against Bezos?

Official ruling:

Fire Sale!

Next up:

Tesla

Fire Sale or Future Ash?

TSLA just had earnings and they sucked.

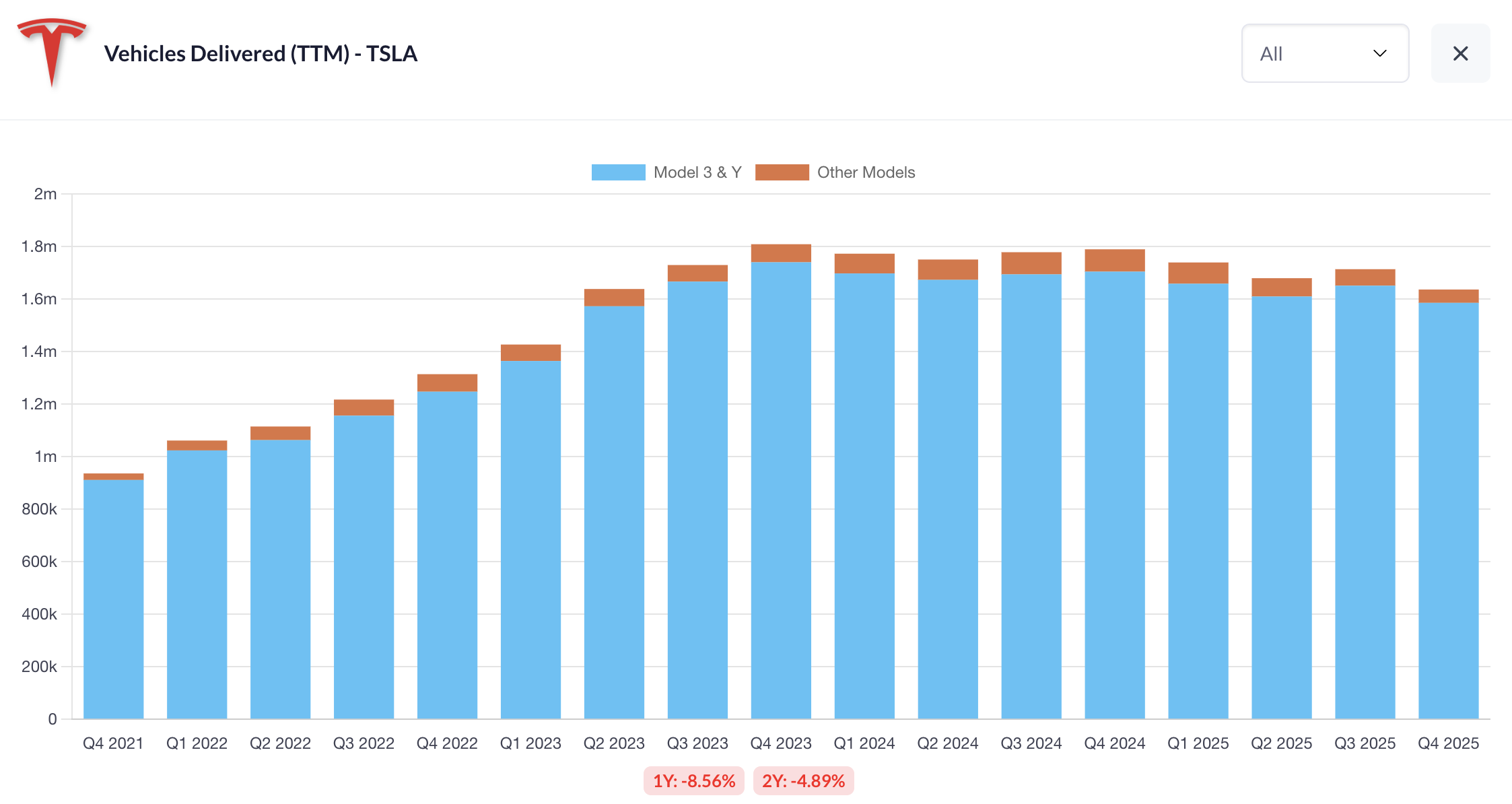

Revenue was down 3%.

Operating Income was down 11%.

Here is where I’ve been putting the AI-ish related revenue, but they have none. It is just car sales and energy revenue.

And yet:

Everybody loves TSLA. It never matters what the company is actually doing. All that matters is what Elon “What day/night will be the wildest party on your island?” Musk says they will do in the future.

Are they a car company with declining car sales?

Yeah, but that is so yesterday’s news because…

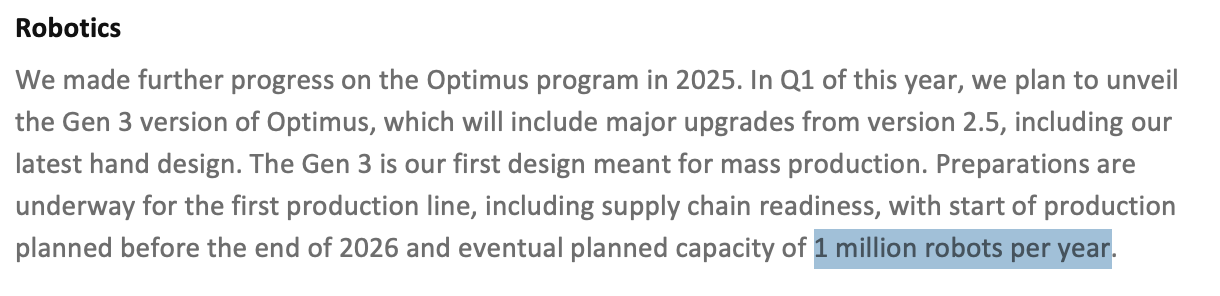

ROBOTS!

Ooooooooh la la.

Production of 1 million robots per year…

So fancy.

Investors, as usual, love Elon’s glowing vision of the future and don’t care at all about the valuation.

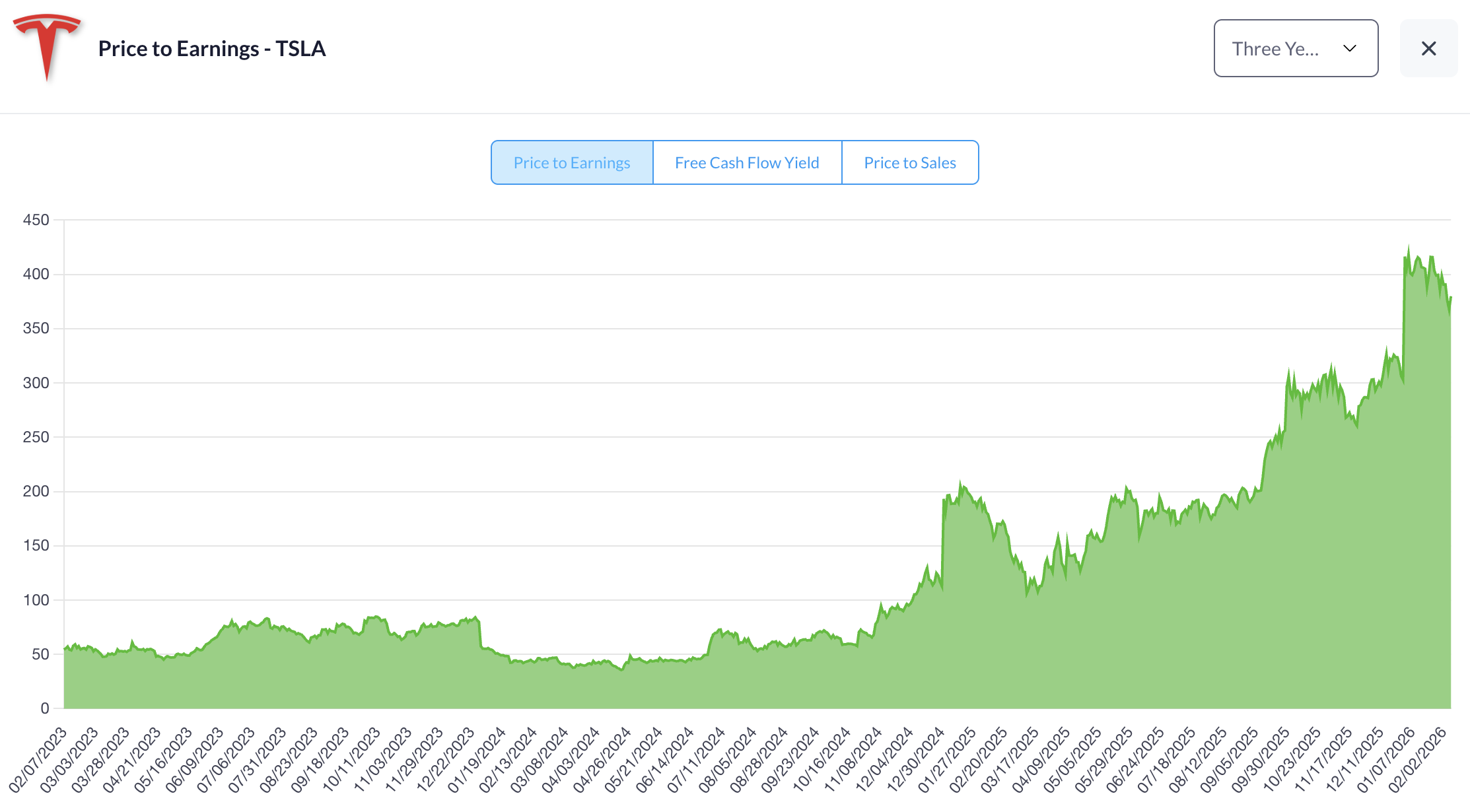

Expenses are up, revenues are down, Google’s Waymo is eating their lunch on the robotaxi front, and the valuation is sky high:

(Lower is better if you are looking to buy.)

But ROBOTS.

There is definitely no way production gets delayed, or customers don’t want to buy all of Mr. Epstein Island’s robots…

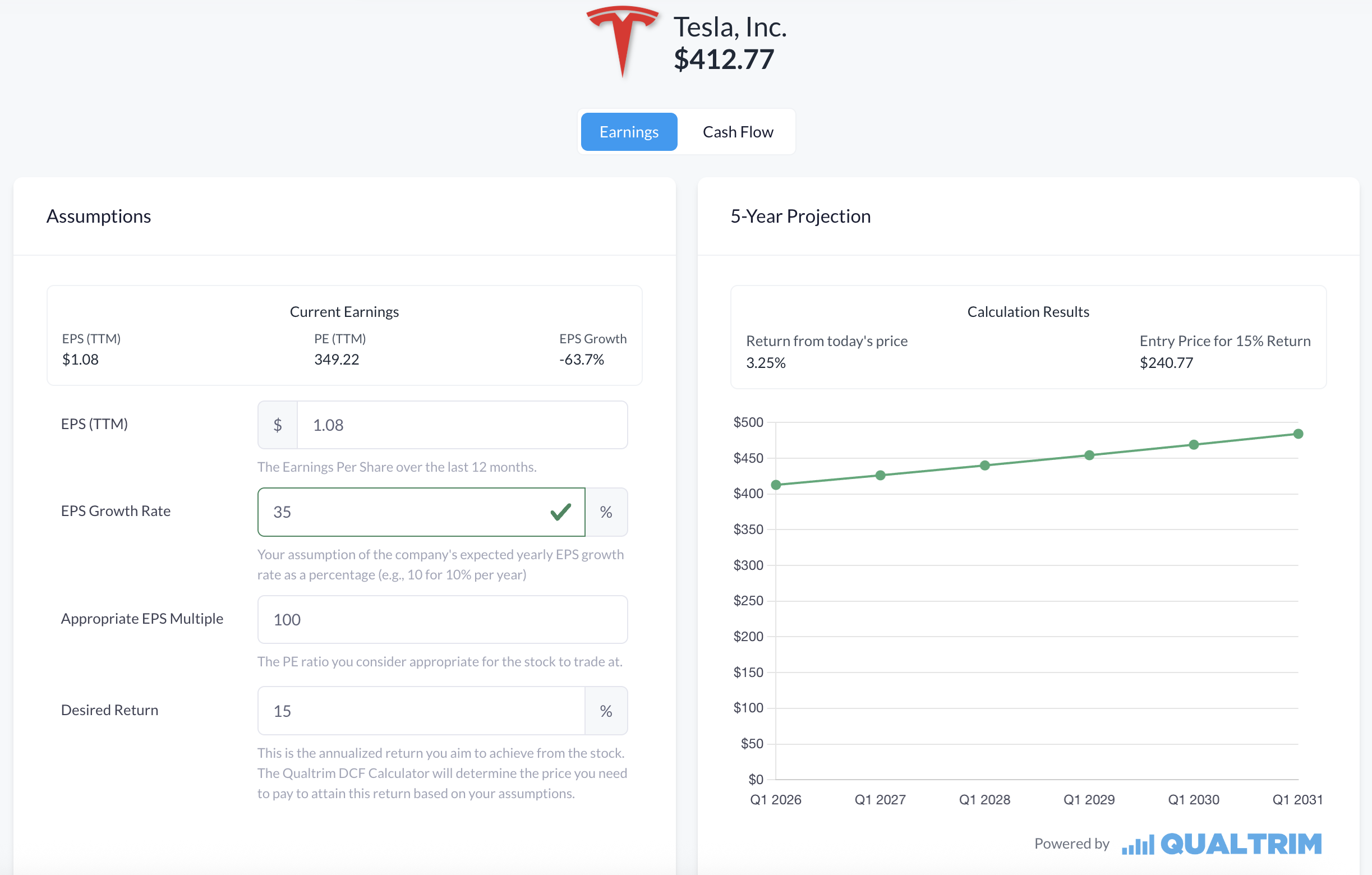

Even accounting for massive 35% annual EPS growth over the next five years and a ludicrous 100 PE multiple, a good place to buy in would be about half of the price it is today.

Official ruling:

Future Ash!

Next up:

Duolingo

Fire Sale or Future Ash?

Oh curveball. Got to keep you on your toes.

DUOL has been in free fall since this summer and is taking another leg down with the market sell-off.

A history lesson with Davey Hardcover:

Back in the day, before guys like Warren Buffett and Benjamin Graham wrote the books on investing, they would be able to get companies at a valuation cheaper than the amount of cash that company had in the bank.

Warren referred to them as cigar butts. Usually dying companies, but prices so cheap he knew they had “one last puff” where the valuation would come back up.

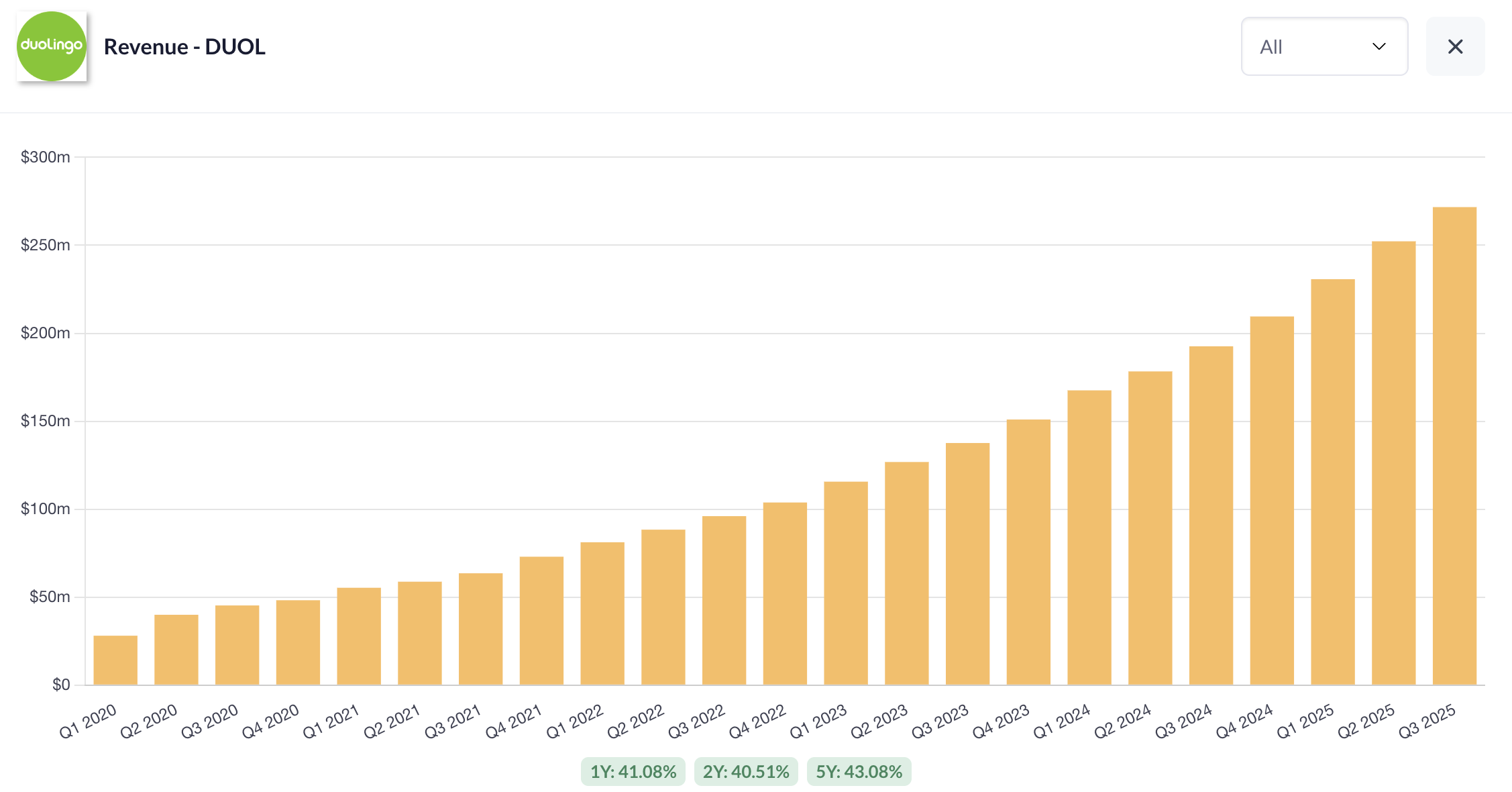

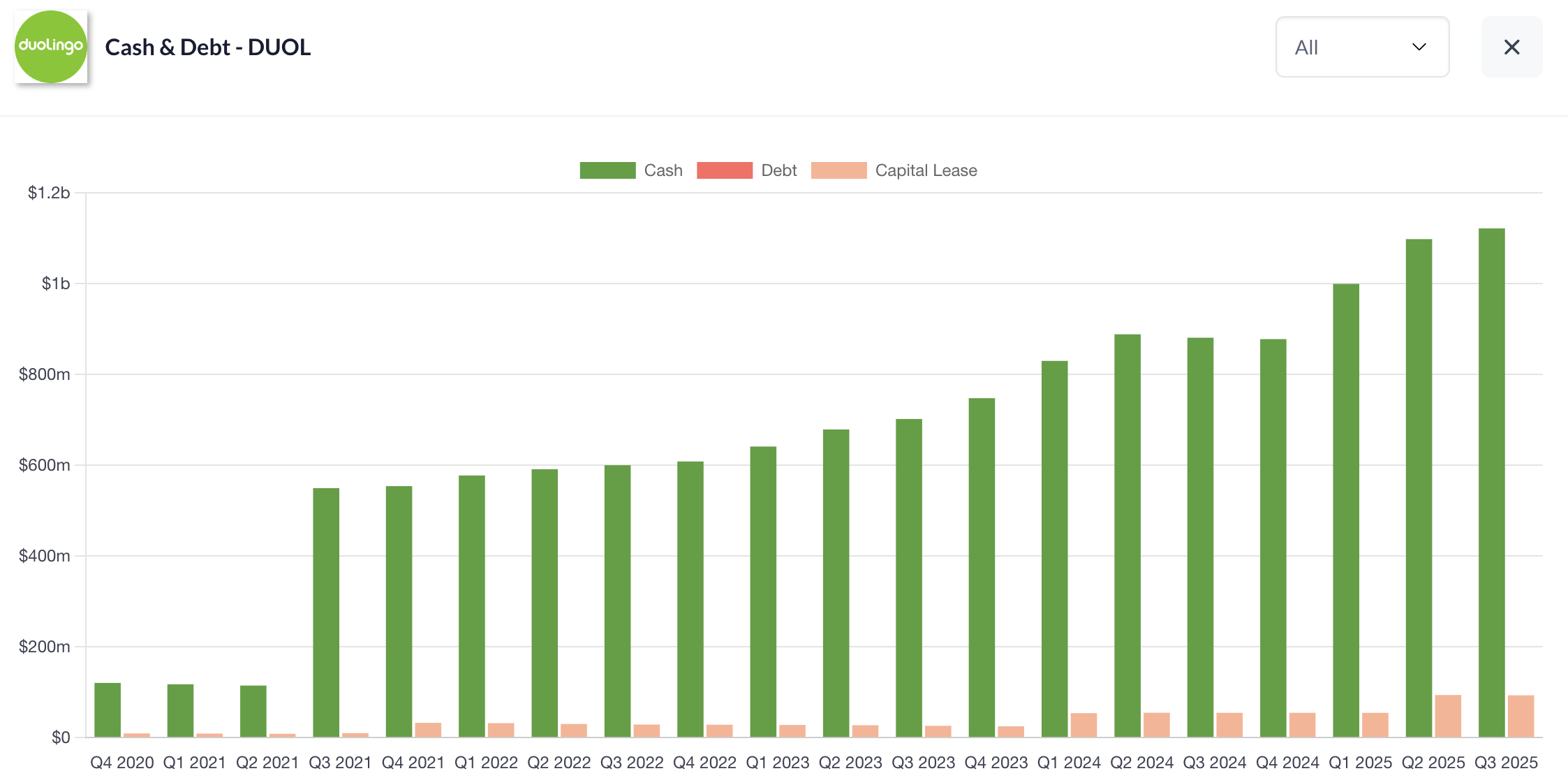

DUOL has $1.1B of cash on hand and the company is at a market cap of $5.5B.

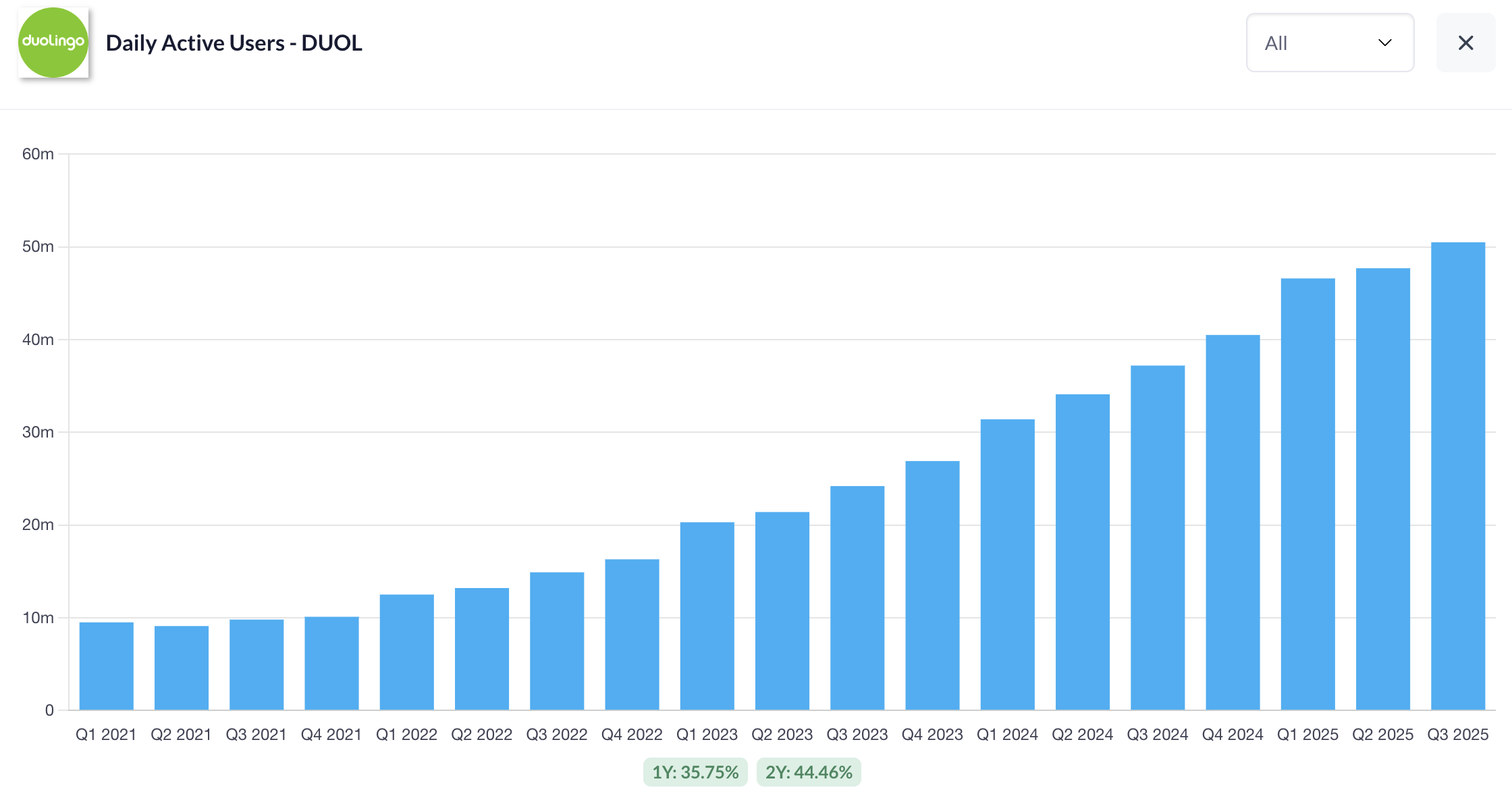

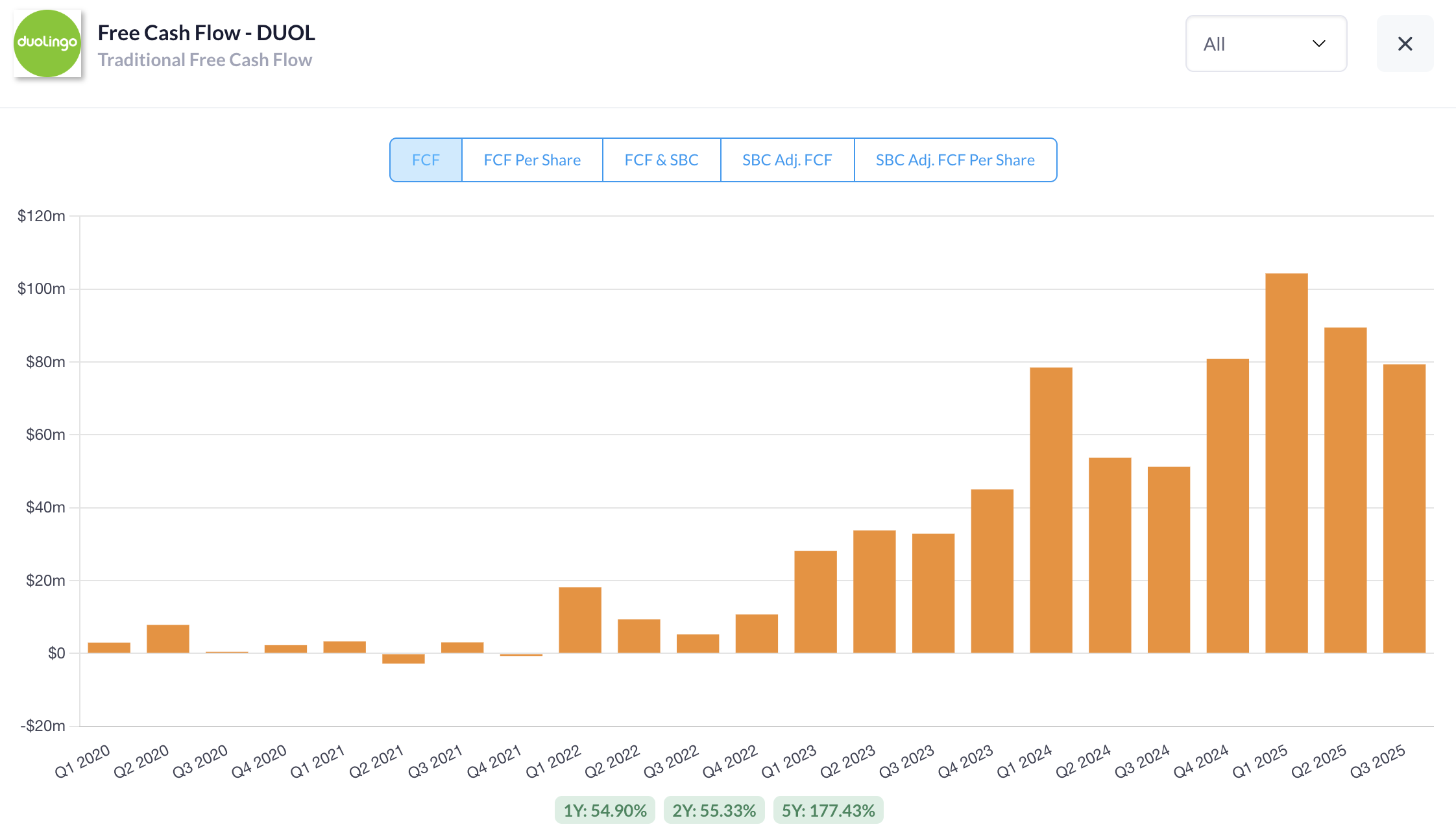

A value 5x the amount of cash on hand is about the closest thing we will see to one of Warren’s cigar butts in this era. Only it isn't a dying company at all. Just take a look at any of these metrics and tell me what you don't like.

DUOL sold off big on the AI spook and management saying they’re focused on long-term user growth rather than short-term profitability. Fine with me. Puff puff pass.

Official ruling:

Fire Sale!

Rapid fire round:

Next up:

Netflix

Fire Sale or Future Ash?

This is getting really long and I’ve been talking again and again about NFLX.

Official ruling:

Fire Sale!

Next up:

Uber

Fire Sale or Future Ash?

This is getting really long and I’ve been talking again and again about UBER.

Official ruling:

Fire Sale!

Next up:

Meta

Fire Sale or Future Ash?

I’ve only dipped my spoon in META one time, but at the rate they’re growing, the valuation is dirt cheap.

Official ruling:

Fire Sale!

Finally….

Next up:

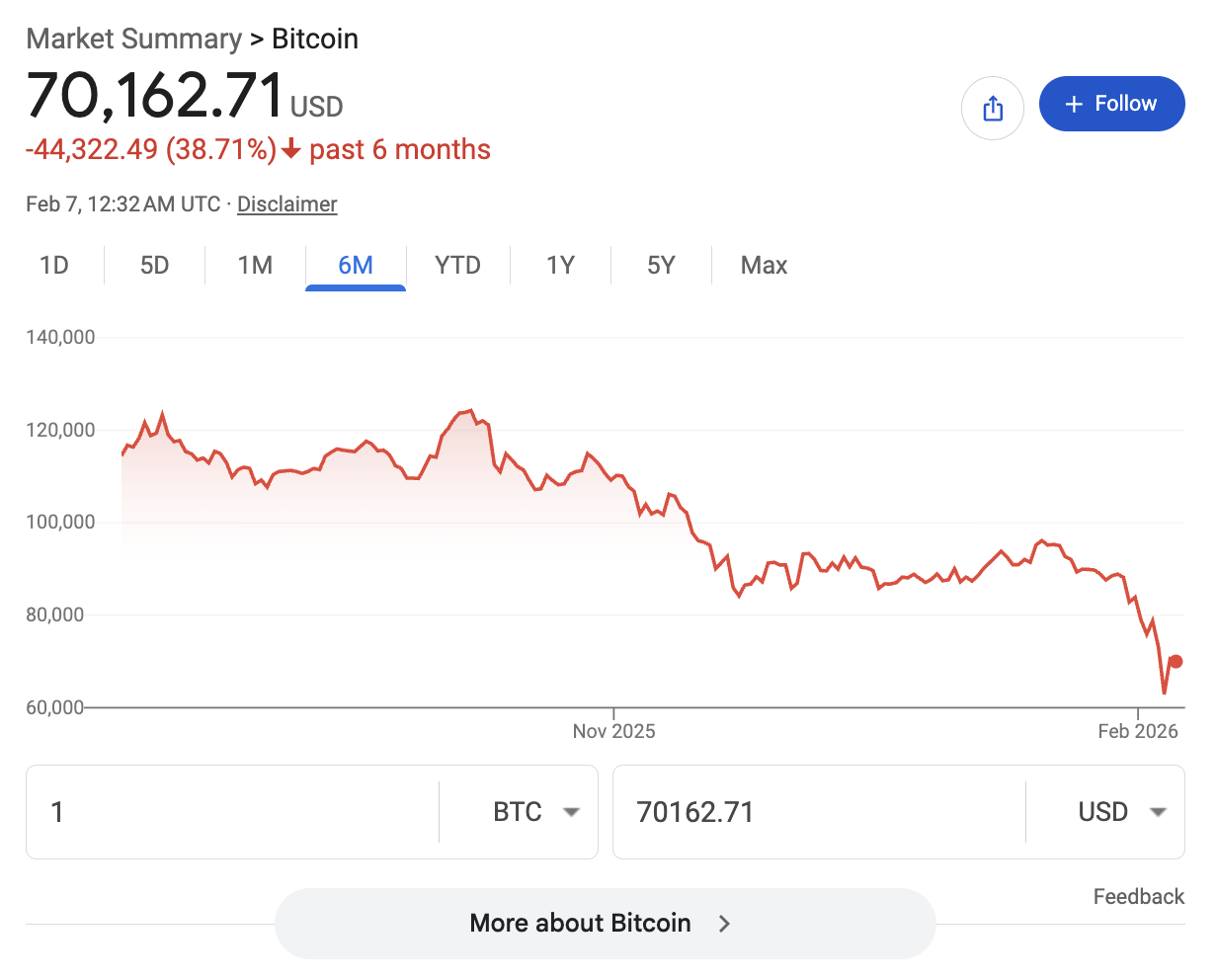

Anything Crypto Related

(BTC, ETH, XRP, MSTR, COIN, etc.)

Fire Sale or Future Ash?

Despite:

1. Crypto president in office

2. Crypto-friendly regulation

3. Spot ETFs of all the big coins

4. The SEC not allowed to regulate coins

5. Safe haven assets like gold breaking all-time highs

6. Full adoption from all traditional banking

7. Full adoption from every generation

8. The technology working as promised

9. Your fast-talking cousin still being totally behind it

Ya silly coins be burning.

Official ruling:

Future Ash!

Final Thought

I think it was Warren Buffett who said,

“Bitch, you didn’t just plant a fucking money tree

When you buying BTC, at over 70 G”