The Fattest Company in the World

Welcome to the Schmoozeletter Blog. Your source for weekly water cooler wisecracks from the world of finance. If you have an opinion different than mine or a topic you want to hear about, let me know!

This week, we’re talking about:

The Fattest Company in the World

This week we have a special request. An avid Schmoozeletter fan hit me up and said you gotta talk about Microsoft, MSFT.

They’re dominant.

They’re massive.

They could put down a thousand hot dogs at the Nathan’s Fourth of July Hot Dog Eating Contest and spike the mustard belt right in Joey Chestnut’s face.

Exact quotes from this person.

When it comes to Microsoft, there is no doubt about one thing:

They’re phat.

No, I don’t mean phat like the hip slang for “cool” that all of Gen Z is surely using on the TikTok. I mean fat as in heavy.

Smarty-pants capital slinger Benjamin Graham said:

"In the short run, the market is a voting machine, but in the long run, it is a weighing machine."

Which is a fun way to say that what drives the stock price over the long run is determined by the fundamentals.

In the short run, the stock price is just set by who is the most popular. And no doubt, a top vote-getter from all the phat kids on Twitter right now is Palantir, PLTR.

Wow, sick analysis, Giul. You see how those two lines cross? $200 easy.

But PLTR did $3.4B in revenue the past twelve months and is at a market cap of $416B.

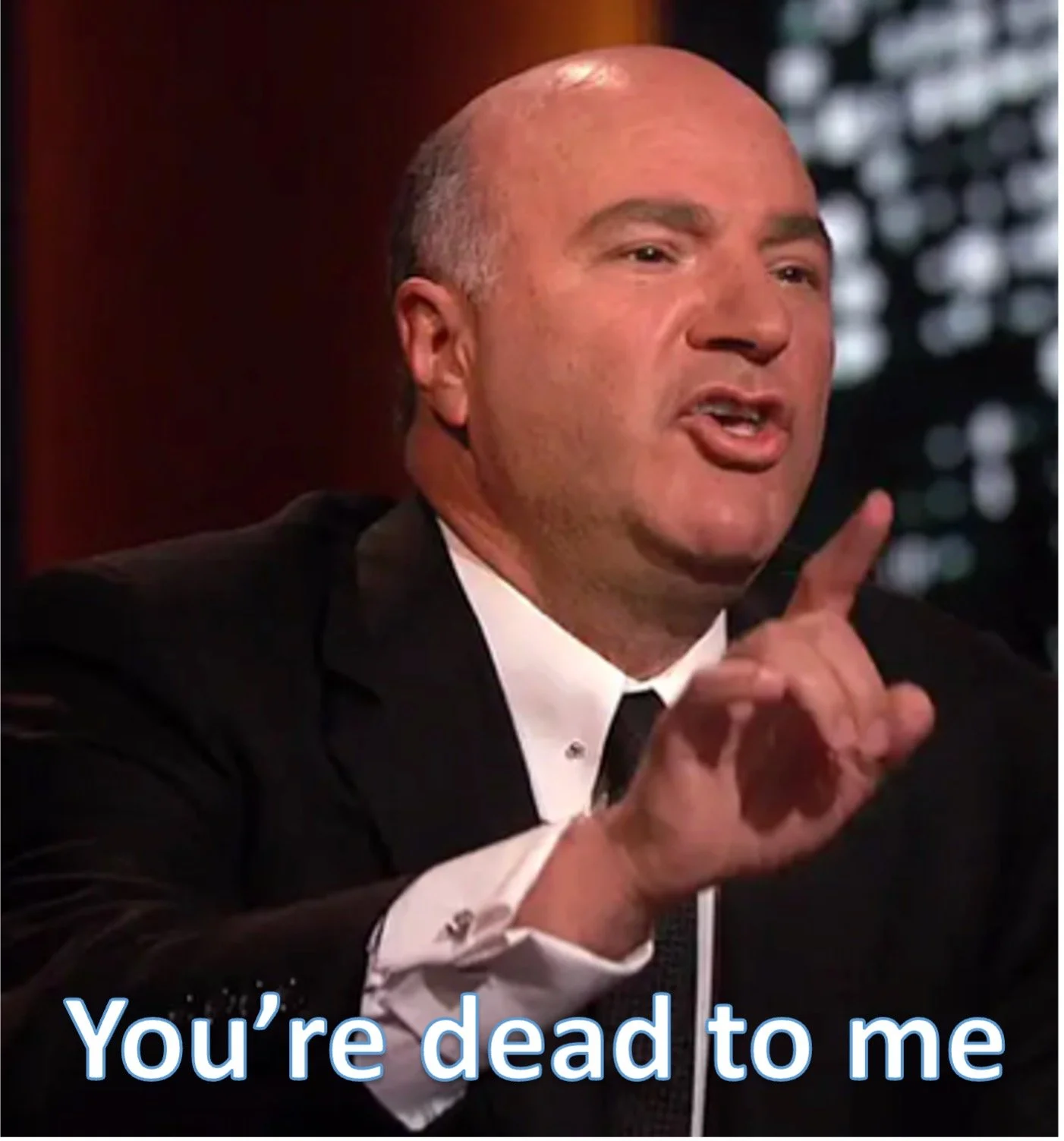

To put that in perspective, imagine you walk into Shark Tank with a business. You’re feeling yourself because you have been growing rapidly. You stand up there and say,

“We’ve done $1M in sales the past twelve months, so my company is worth $120M.”

Your company don’t weigh that much, muchacho.

So if we’re looking at the most expensive company in the world, the leading vote-getter with the highest market cap, it is Nvidia, NVDA.

But if we’re looking for the most fundamentally sound company in the world, the heaviest weight with the best metrics, it is Microsoft, MSFT.

Let’s start with their products:

Just a brief list of the most prominent products, but there are hundreds more, says Google. Brief like the lifespan of a doughnut in my vicinity. Zing.

How does this translate to the fundamentals?

Fan of colorful charts that go straight up and to the right?

It’s not just that the business is growing at double digits as a whole. It’s how many different business segments are growing by 10% or more. This slide is pretty remarkable.

Double-digit segments growing at double digits. I haven’t seen this many hefty digits since King Charles was in the rotary phone store. Wocka wocka.

And when another company fits in their ecosystem that would help the bottom line, they’ve got the cash to slide them right down their meaty gullet.

Microsoft has great leadership with a great CEO, great products in a growing ecosystem, they’re great allocators of capital, they’re great to shareholders, and they have plenty of avenues for future growth. They are no doubt fat and getting fatter. So what is the downside?

Are they so obese we are going to start to see health problems?

Nah, not really. They are diversified across so many different independent business segments they are basically like a tech ETF at this point.

I’d say the only real knock I can think of on MSFT is valuation.

The stock ain’t cheap.

But it’s not exactly expensive either. Sure, it’s at a higher multiple than the average company at a forward P/E in the 30s, but this is the FATTEST COMPANY in the world here. It deserves to trade at a premium.

Also, the longer your timeframe, the less the current valuation really matters.

Back in the dot-com bubble, MSFT was trading at a sky-high valuation with an 80 P/E multiple.

A terrible value!

And how would you have fared if you bought and held it from back in 2000?

You would have been down for a period but be up 10x on your investment by today.

So in the long run, if the market is a weighing machine, not a bad strategy to roll with the fattest company around.

Final Thought

I wasn’t really watching the markets Friday. I came back, took a look at this chart, and thought, “What did he say now?”

Sure enough, at 11:00 a.m., the Twitchy-Finger-in-Chief was on social media bashing China.

The “Pro-Business” candidate…