Where Were You at My (Market) Lows

Welcome to the Schmoozeletter Blog. Your source for weekly water cooler wisecracks from the world of finance. If you have an opinion different than mine or a topic you want to hear about, let me know!

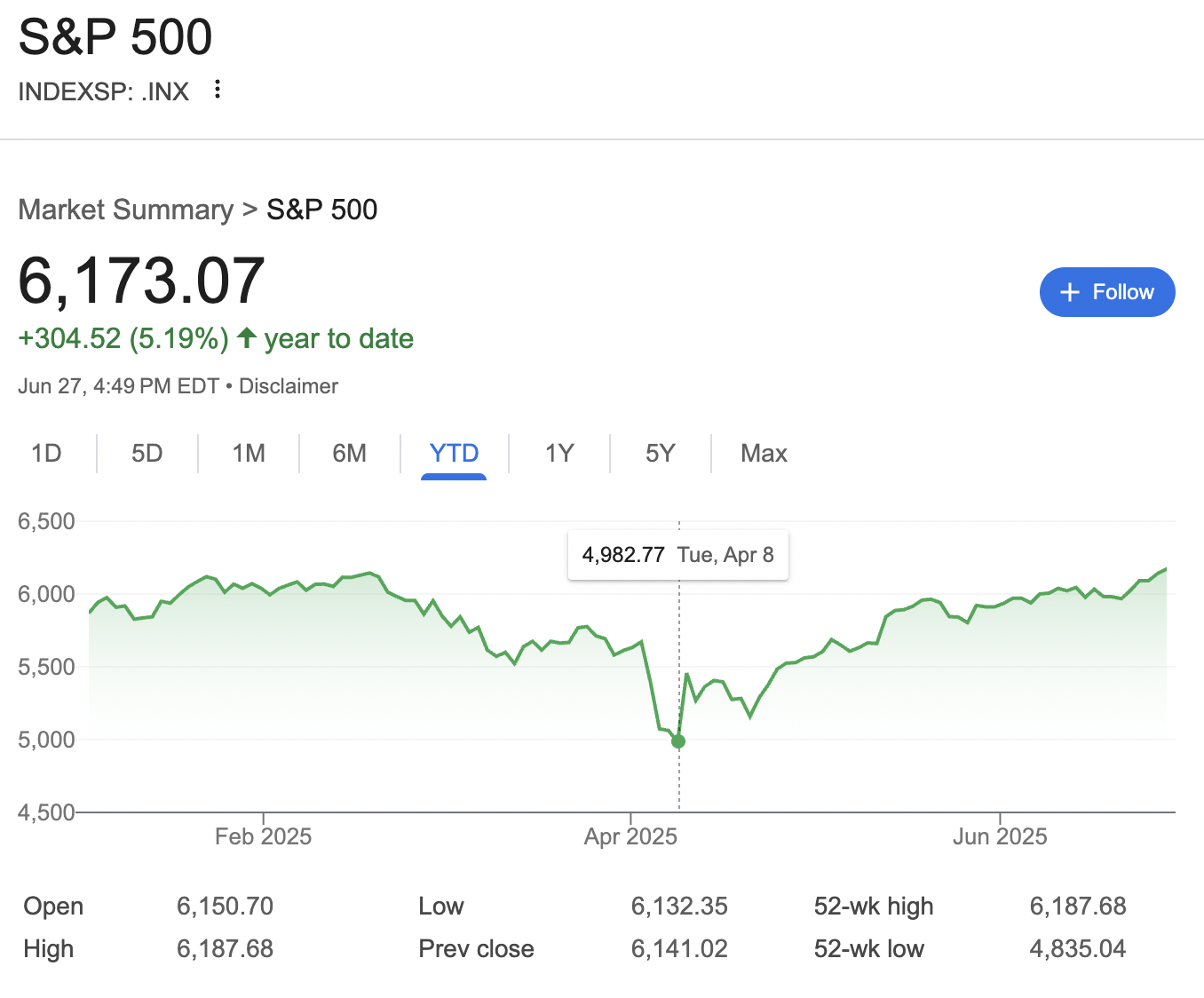

This week, Mr. Market goes zooming over all-time highs!

You read that right.

Now that may have snuck up on you. You may be thinking, “Say what? This week?”

It’s true.

In a week where:

The US bombed Iran.

Iran bombed a US base.

US GDP is officially going backwards.

Inflation data was worse than expected.

Trump says he is terminating trade talks with one of our biggest partners, Canada.

Mr. Market took all that in and figured….

It is important to remember what “the market” is. It is a collection of the 500 biggest businesses in America.

Quarter after quarter and year after year, these businesses make more and more profits. The stock prices will fluctuate in the short term, but go up over time. Betting it will go down over the long term has always been a losing proposition.

For the market, there is the long side or the wrong side.

I just made that up and refuse to Google if anyone has ever said it before, so credit me with that quote for eternity.

But it’s easy to say all this now, when the market is at a top. What was being said back in April when the market was at lows and the sky was falling?

Funny you should ask, because I published a Schmoozeletter on April 6th titled, “To Panic or Not To Panic.” That was the Sunday closest to the bottom.

I’ll save you a click—I said not to panic sell.

So that’s where I was. But where were you?

Where Were You at My (Market) Lows

Let’s take a fun look at what the “experts” were saying when the market hit lows in early April.

Here is a great one from Forbes. They even put numbers in there for you: sell now, and wait until it hits 20% lower to jump back in. Some foolproof market timing there…

Except it never got to their price. It never got 1% lower than April 9th, let alone 20%. If you took this advice, you'd still be in cash and missed out on a double-digit rally.

Oooof, I cannot bear this bear market.

Whoops, it’s a bull now.

My bad…

“Sell into every rally!” says Bank of America’s Harnett.

Who I can only assume is Hollywood heartthrob Josh Hartnett doing a BoA commercial, and not someone paid for their analysis, due to how completely wrong this advice has been since April 11th.

Sell the market!

Buy gold!

Let’s take a look at how that would’ve worked out if you sold your “broken” market index fund and pulled the golden trigger in late April.

….the top one is the market…

Narrator voice: it did not drop 7% or 8%.

Alright, let’s rapid-fire some Seeking Alpha experts. The way these work is they have a “SELL” under the title if they think you should sell a market index fund at the date the article was published. Let’s start with one so dead-on it got a special gold star of “Editor’s Pick.”

Catchy title!

Lolz.

Silly Fountainhead. Always spouting dread. The longer-term trend remains bullish, just like always.

So head into July 4th confident that over the long term, there is no simpler, easier, lower-cost, more convenient, set-it-and-forget-it tool for growth than a good old American market index fund.

Final Thought

“For the market, there is the long side or wrong the side” – Dave Krause