To Mediocrity and Beyond (Meat)

Welcome to the Schmoozeletter Blog. Your source for weekly water cooler wisecracks from the world of finance. If you have an opinion different than mine or a topic you want to hear about, let me know!

This week, the biggest news in the finance world is:

To Mediocrity and Beyond (Meat)

This week was GameStop 2.0!

In that a failing company got slightly pumped up before falling back down to earth as quickly as it rose.

But boy, was it fun while it lasted. And plenty of YOLO’ing WallStreetBetsters lost everything and didn’t post about it made some money going long the stock.

I am referring to Beyond Meat, BYND. Want to hear the best way to profit on this year’s meatless meme stock mania?

All you have to do is wait for the charts.

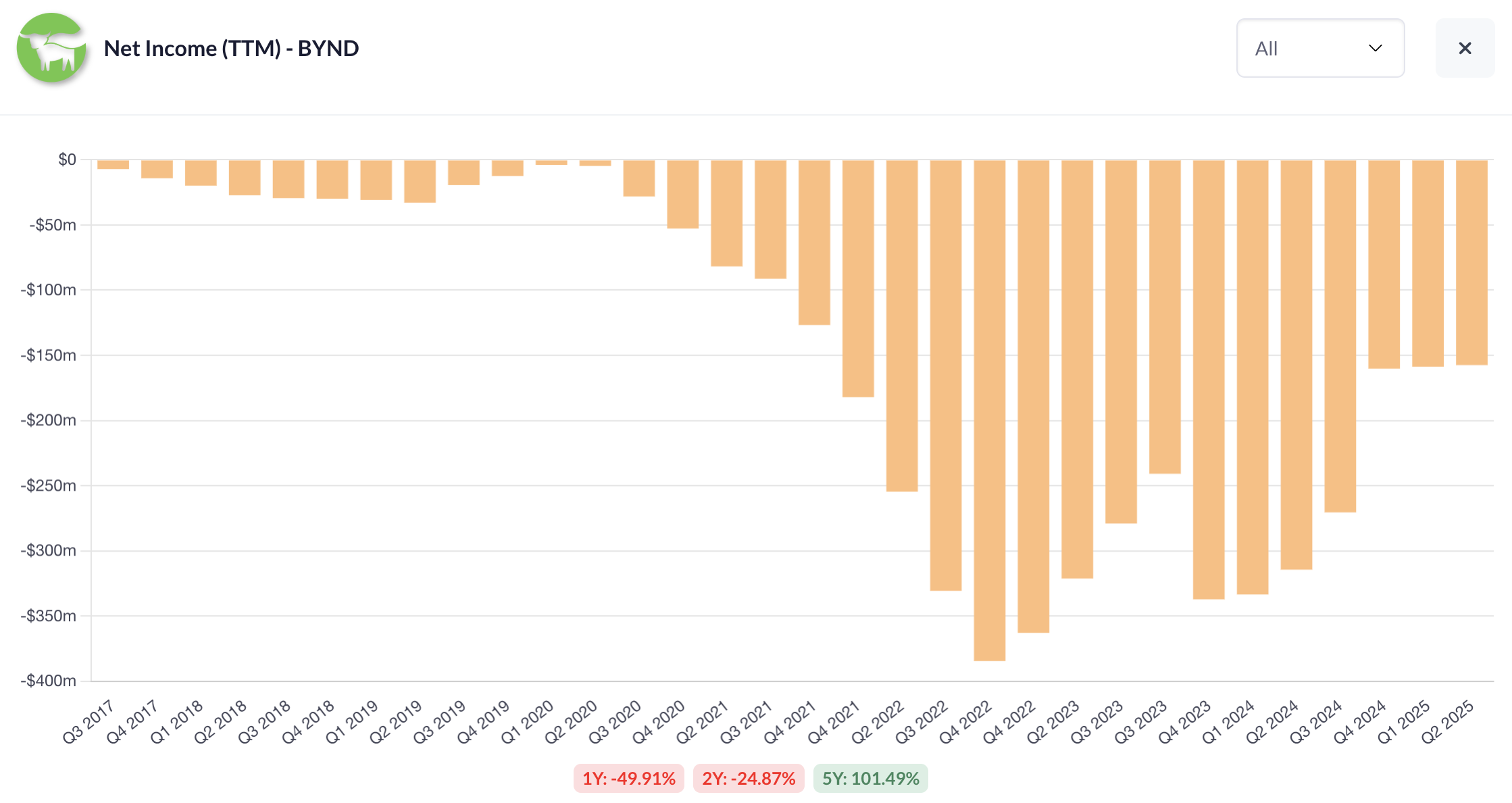

Let’s talk about what the bean burger buffs are investing in here. To be vegan frank, it is a dying company.

The revenue is down.

The net income is negative.

They’re burning cash and up to their tofu eyeballs in debt.

You don’t need to be a CPA to see there are better places to put your capital that have more meat on the bone — as in, places that make money and sell meat. See Texas Roadhouse, TXRH.

But the kale-crusading capital slingers don’t care about the actual state of the company. They are just looking to turn this green beef into greenbacks.

Nobody is investing here. They are gambling.

And who am I to deny the public what they want?

So, you want to know the best way to make money gambling on BYND?

All you have to do is wait for the charts.

This is a TradingView chart of BYND stock price and volume. TradingView is a free website that you can look at right now if you’d like. The stock price is listed to the right, and the volume bars are at the bottom.

Now, I’m sure you’ve noticed the way the stock is trending over the long term...

It’s down.

But did you notice the volume?

Might not look like there is any volume. Let’s zoom in.

Still kinda messy, eh?

Let’s zoom in again.

There we go.

See those volume bars at the bottom?

They are so huge they make every other bar look like zero. This is massive volume. On Tuesday, over 2 billion shares were traded when the price was around $3. So six billion real dollars were changing hands on this failing fake sausage firm.

Sidenote: Does anyone like Beyond Meat? I understand with GME that people were nostalgic, but does anyone look back fondly on sitting down with the family for Sunday dinner and sucking down some Beyond Sun Sausage Pesto Plant-Based Links?

Anyway…

Back to that chart. Last Friday, BYND closed at $0.65. On Tuesday, the stock closed at $3.62 with what we call in the biz “parabolic” volume.

This is where we look for what is known as the “First Red Day.” AKA the first time this thing is going to crack back down to earth. The first day all the “apes” from the forums have made tons of money and are starting to take their chips off the table.

Look no further than Wednesday morning.

The stock was up another 100% in pre-market trading and eventually opened at $6.17. That is about an 850% increase from Friday on that parabolic volume. That’s a pretty good indication that it is:

Look out below!

At this point, we enter our step-by-step instructions:

1. Determine How Much You Are Willing to Lose

You are gambling here. This is an art, not a science. You don’t know what’s going to happen any better than the foolish faux steak financiers who think they are “taking down the hedge funds.”

For this example, let’s say it’s $100.

2. Buy Puts

This is a screenshot of a put contract on Robinhood. This is a “free” broker. (They actually charge about $0.04 per contract and call it “regulatory fees,” but that’s a very small fee.)

This screenshot is from 9:30 a.m. and 37 seconds on Wednesday the 22nd. A $6.50 put contract cost $0.25 at the time. The price of BYND was $6.21 at the time.

Each contract is 100 shares, so you could buy 4 contracts for $100.

3. Profit

Or don’t. There is a chance the stock just keeps running and you lose the $100. Your puts expire worthless and you’re left to bury your sorrows binging cheesesteaks and wings. At least it’ll be with real ribeye and delicious, juicy chicken.

But generally, what goes up…

on misguided investors thinking they’re part of a revolution by pumping a worthless company and irrationally expecting everyone will band together and forgo profit-taking to be part of some diamond-handed rebellion of strangers on the internet…

must come down.

A day later, the stock was down at $3.45, and the puts were up to $3.60.

So those four contracts you could have bought for $100 were worth $1,440 for a gain of 1,340%.

But you didn’t even have to wait that long. You could have locked in a 1,000% gain by Wednesday afternoon if you wanted to.

This game is all about the best place to stake your capital. And making ten times your risk in a single day off a rotting fake beef company, I’d say that’s a stake well done.

Final Thought

The interesting thing about Trump’s blatant corruption is it is immortalized on the blockchain for all to see.