Have Your Cash and Eat It Too

Welcome to the Schmoozeletter Blog. Your source for weekly water cooler wisecracks from the world of finance. If you have an opinion different than mine or a topic you want to hear about, let me know!

This week, we’re talking about:

Have Your Cash and Eat It Too

They say in life you can’t have your cake and eat it too.

I say they’re full of shit. That is the only way to have cake.

The stock market is the same way.

You can’t have your cash and eat it too.

Or rather, you can’t have a high-yield asset that will also have big price appreciation.

They say:

You can’t be receiving cash AND have the stock price go up by a lot.

But that is exactly the situation we find ourselves in with Schmoozeletter-favorite REIT, VICI.

What is a REIT, you might ask?

A REIT, or more specifically an equity REIT, is essentially a landlord company.

They own property.

They rent it out.

They collect cash.

Pretty simple.

In order to stay in their special tax classification of REIT, they must distribute 90% of taxable income as dividends to their shareholders.

Meaning, they pay you the cash!

Because you are getting the return in the form of that sweet cashola, it is unlikely that price is going to skyrocket.

Or is it?

Well, let’s take a look at our favorite REIT and REITs in general.

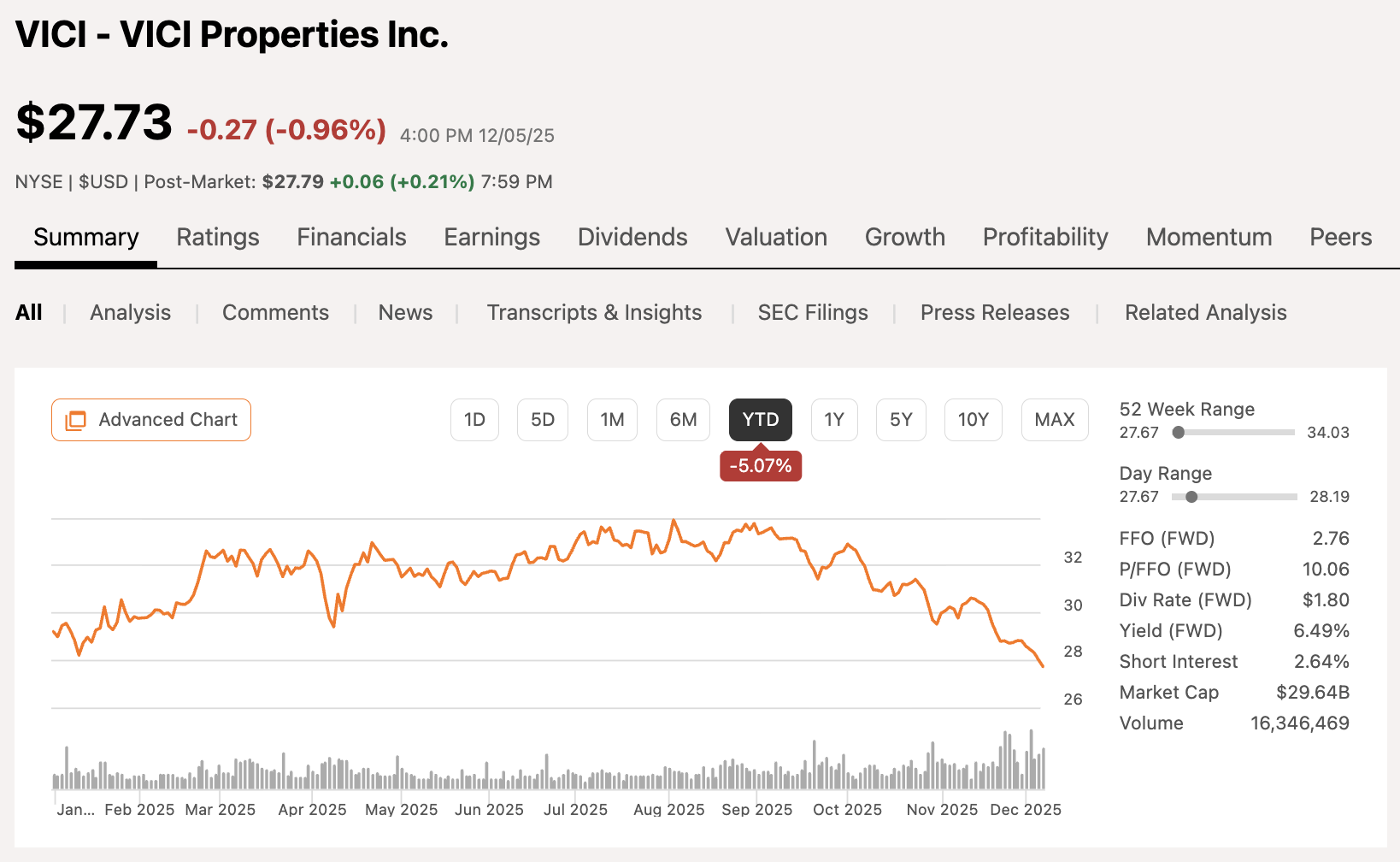

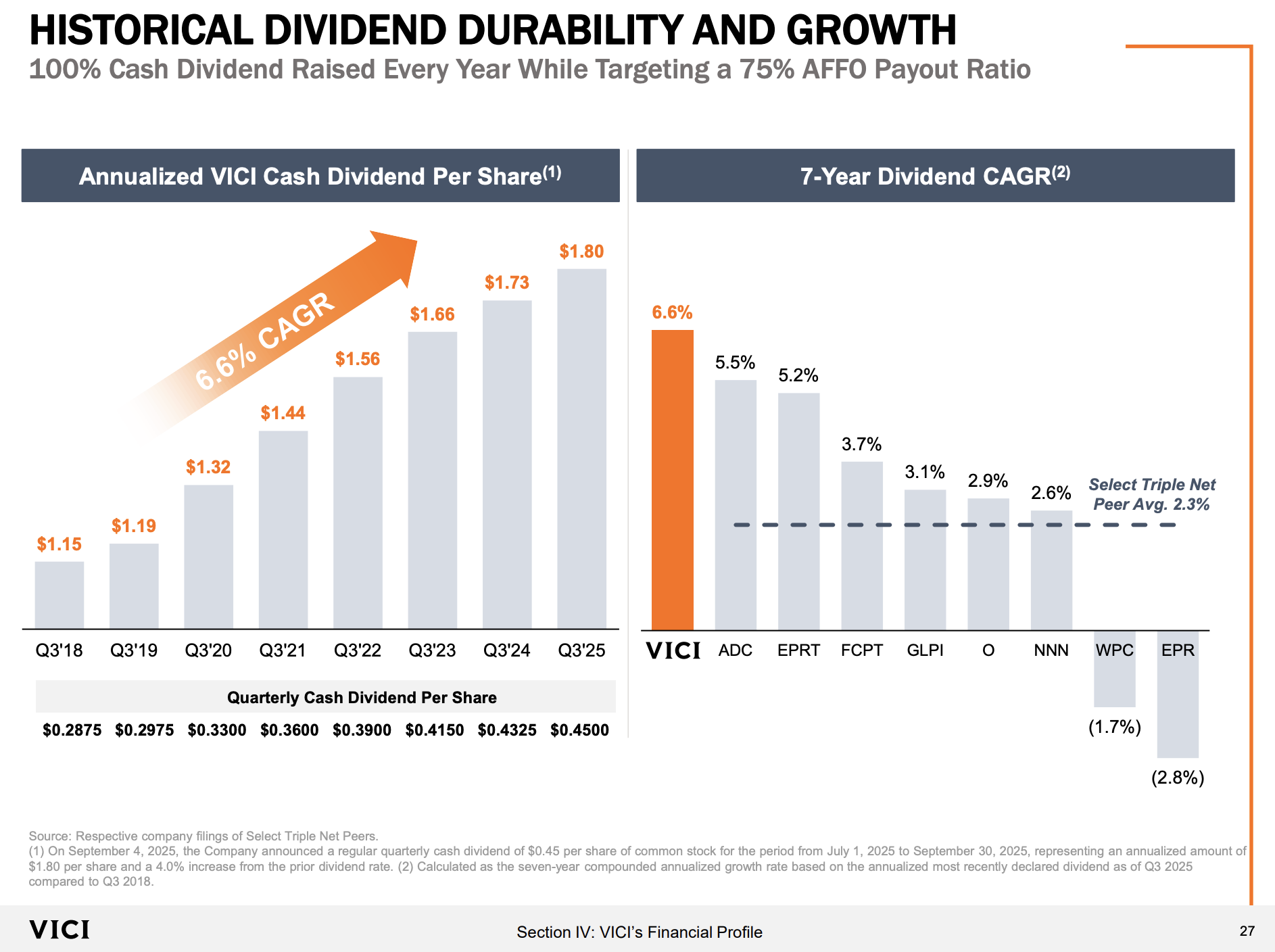

VICI is at a 6.49% yield. Meaning for every $100 of VICI you buy, you receive $6.49 in straight cash, homie, over the next twelve months.

So at these prices, we’d certainly be getting our cash. But can we eat it too?

Well, I’m not really sure how the price can get much lower.

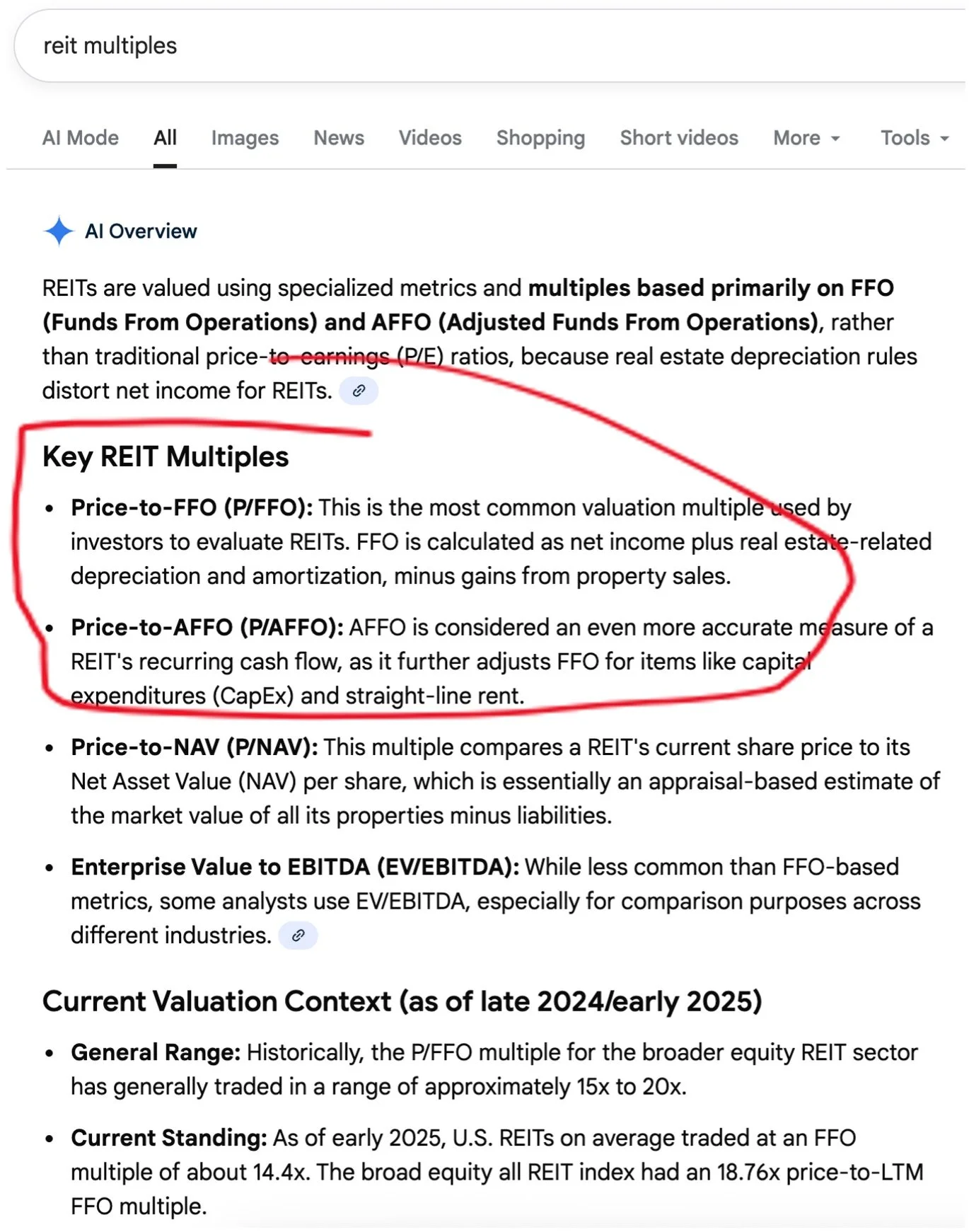

When talking about stocks, it is all about the earnings multiple.

A company’s stock price as a ratio of their earnings. This way you can hit people with the great quip, It is just not trading at a multiple I’m comfortable with.

But REITs need to pay out their earnings, so for a REIT it is all about their Adjusted Funds From Operations multiple. Just ask Google.

But right now, everybody hates REITs.

Usually, REITs are at a multiple of 15x – 20x. With interest rates going up the past few years, they are down at a multiple of 14x and heavily discounted compared to stocks.

Meaning REITs are on sale, baby!

Also, as interest rates go down, in general, REIT prices tend to go up.

Do you know of any orange leaders who have been complaining about interest rates being too high and are about to replace the independent Federal Reserve Chair with one of his jackass cronies who will simply do his bidding?

I’m guessing we see interest rates come down next year.

So REITs will likely benefit from falling rates AND they are already at historically low multiples.

But what multiple is our friend VICI at?

Historically, REITs are at 15x – 20x, now the sector is down at 14x and VICI is at 10x – 11x.

Me likely.

Why the big sell-off?

Wall Street downgrades!

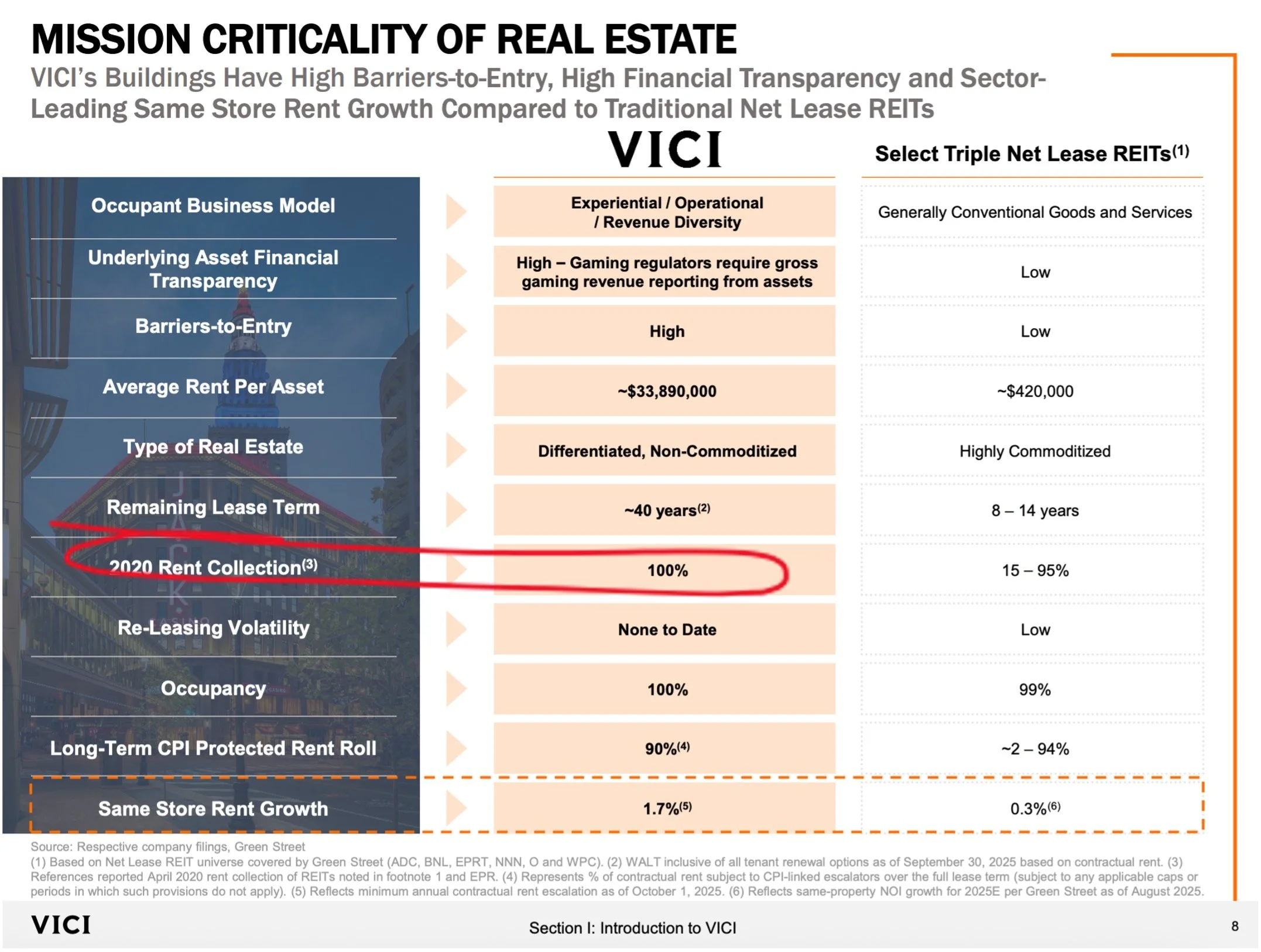

In order for VICI to miss a dividend payment, it would mean Caesars, MGM, or The Venetian would need to miss a rent payment.

Not just the casinos have their profits down or Vegas tourism takes a dip. We are talking full-on going broke.

In order for VICI to miss a dividend payment:

One of the three most prominent casinos on the Vegas Strip would need to miss a rent payment.

Man, if only there was a time recently we could look at where people had to stay inside and couldn’t go to Vegas.

Oh, that’s right.

Covid.

Surely, they must have missed a rent payment then, right?

Nope.

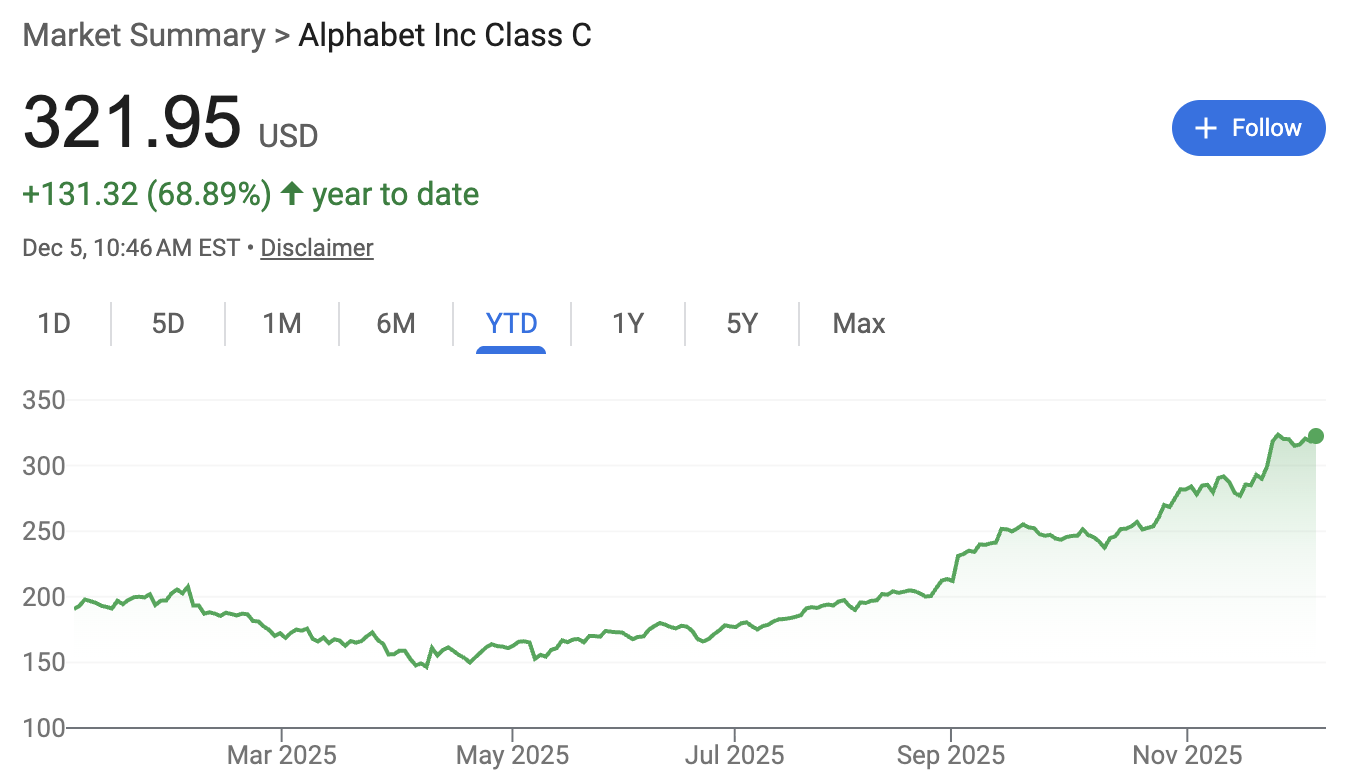

Who else have the geniuses on Wall Street downgraded this year?

Wow, great call.

With VICI, anytime you buy in, you can have your cash.

But with VICI at these prices, you can have your cash and eat it too.

Final Thought

Hope you sold your SOFI before the company diluted all over your face.