Checking In on the SCHD Haters

Welcome to the Schmoozeletter Blog. Your source for weekly water cooler wisecracks from the world of finance. If you have an opinion different than mine or a topic you want to hear about, let me know!

This week, war in the Middle East overshadowed good economic data as Mr. Market closed red on the week.

In many ways, the stock market is an incredibly simple place.

You want a high total return over the long run?

Buy a market index fund.

You want to receive cash payments growing four times the rate of inflation?

Buy SCHD.

End Schmoozeletter.

That can really be it. You could be in two funds your entire life and statistically outperform everyone who writes about investments while living an incredibly comfortable life.

But that’s no fun!

Everyone wants to chase the hottest crypto or the latest covered call ETF or Uncle Know-It-All’s trendiest biotech company to try and beat the market.

In the meantime, King of Total Return and the King of Cash Flow get article after article of potshots from the peanut gallery who will never touch their crown.

So every once in a while, it’s fun to check in on the naysayers. Do they make good points? Or are they just yipping at the top dogs for attention? Let’s investigate in…

Checking In on the SCHD Haters

Most people know a market index fund. It is…

An index of the 500 largest companies in the U.S.

You outperform this, you “beat the market.”

Another popular index ETF is SCHD. It is…

An index of the 100 best dividend-paying companies in the U.S.

This has the best dividend growth, or cash-paid-to-you growth, in the market.

Just like a market index fund, there isn’t some wizard of stock picking behind the scenes at Charles Schwab resulting in its market-leading dividend growth.

It is just an index. Fifty years from now it will follow the same index. The stocks change every year, but the index remains the same.

But as with anything in our hot-take culture, if it’s immensely popular, the clout-chasing clowns have their torches and pitchforks looking to cause a riot.

First up on the Skip and Stephen A. school of stock writing list: Gary Gambino

(Read in Italian accent)

AAAAaaaaaaaayyyy

It’s Gary Goombah, here.

*Waves hands frantically*

Ma’s got a pot a’ gravy on and I got better stock than SCHD.

Whutta you, an idiot.

It’s DIVO.

I go by two rules:

You nevah go against da family and always go with da name that ends in a vowel.

My boy DIVO beats SCHD in total return.

Nuff said.

Score one for the paisan.

*Stuffs cannoli in his mouth*

Well put, Gary.

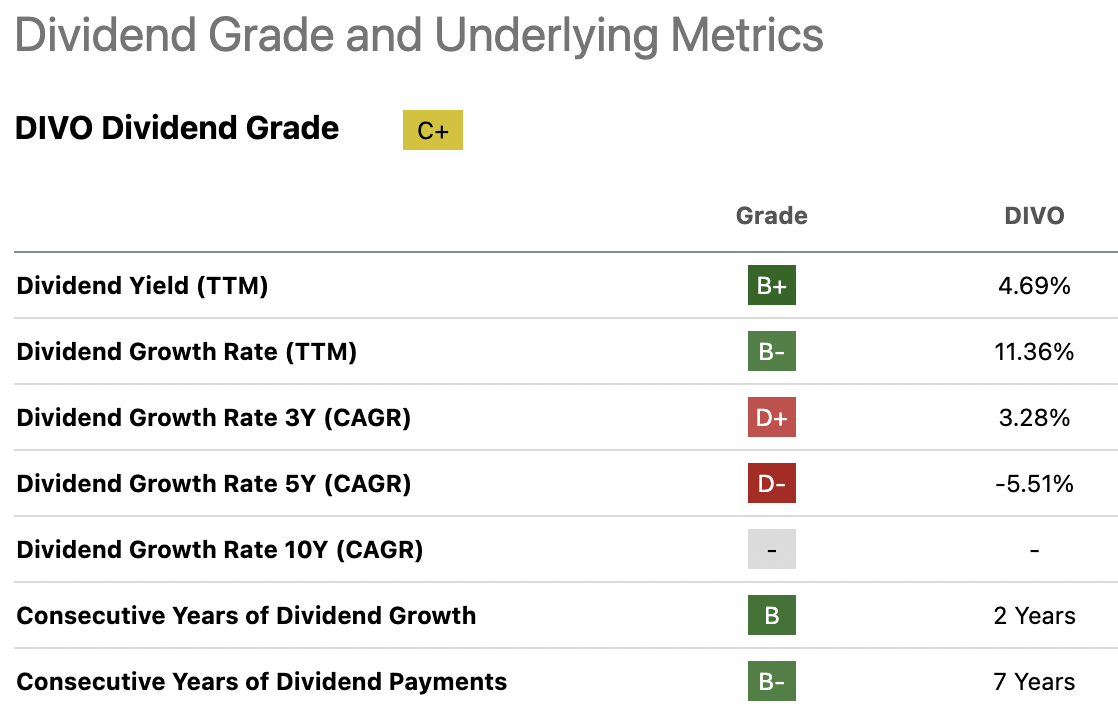

Only, that SCHD is a dividend growth ETF. People buy it for its cash-paid-to-you growth. So instead of total return, let’s compare dividend growth:

Which of these charts of cash-paid-to-you would you rather have for the next thirty years?

If you are looking for total return, just buy a market index fund, which has outperformed DIVO.

But Gary already knows that.

Ghee, ya don’t say.

This is what Mr. Goombah’s article is really about:

Keep racking up that engagement, Gary!

On to the next Security Scrutinizing Shakespeare:

Let’s Get Real: The Only Franke I’m Interested In Is a Delicious Char-Grilled Tube of Questionable Pork Meat

“Chronic Underperformer,” says Pauly boy.

That is the type of clickbait headline that should get Franke roasted over an open flame.

His first point is that SCHD has lower total return than a market index fund. Yeah, we know. But CHRONIC UNDERPERFORMANCE?

Since Frankeenstein thinks SCHD is showing Shelley-esque monster underperformance, let’s compare the total return to a market index fund over the past decade.

The horror!

Nineteen-one-hundredths-of-one percentage point average annual underperformance on total return. That is less than 0.25% per year.

I haven’t seen chronic underperformance this bad since Lil Wayne walked off stage a half hour into his set…

The rest of his points are that he has charts and fancy-pants indicators like the 14-day Ease of Movement indicator…

Ooooh La La

…that say SCHD’s price won’t go up by as much as it has in the past.

To be Franke, I’m not so sure Franke can predict the future.

But if he’s right, that is good news for SCHD investors!

Say what?

Don’t we want to stock to go up?

SCHD is a dividend growth ETF. People buy it for its cash-paid-to-you growth.

So you are either:

1. Using the cash and don’t care about the stock price.

2. Reinvesting the cash.

If you are reinvesting the cash, you would rather buy in at a lower price. You should relish times like now when the stock price is lower than usual.

Let me show you what I mean. Let’s use a dividend calculator with some assumptions that are more conservative than SCHD’s actual historical performance. The only metric we will mess with is the price return:

Starting with $100k, twenty years of reinvesting at a 10% price return would get you a $1.9M portfolio generating $65k in annual dividends. Not bad.

Let’s say now that the price only goes up at a meager 3% each year:

Starting with $100k, twenty years of reinvesting at a 3% price return would get you a $1.1M portfolio generating $147k in annual dividends. Much better.

Your total return is lower, but you don’t care because you are generating more cash.

Finally, let’s look at a Daniel Jones who is worse at analyzing stocks than Daniel Jones was at quarterbacking the New York Giants.

Let me summarize the main point of his article:

Final Thought

“The business schools reward difficult complex behavior more than simple behavior, but simple behavior is more effective.” – Warren Buffett