Cash Flow is Bigger in Texas (Instruments)

Welcome to the Schmoozeletter Blog. Your source for weekly water cooler wisecracks from the world of finance. If you have an opinion different than mine or a topic you want to hear about, let me know!

This week, the biggest news in the markets was:

Economic Data Is Pretty Good So Investors Are Worried That We Don’t Actually Need Rate Cuts And The Market Is Panic Selling A Bit Because Rate Cuts Have Been Priced In Already

Yawn. So let’s talk:

Cash Flow is Bigger in Texas (Instruments)

Well howdy, y’all. Ever stumble upon some projections that make you near ’bout fall off yer pony? If you ain’t done figured it out by now, we’re chinwaggin’ ’bout Texas Instruments, TXN, this week.

The calculator makers?

Darn tootin’.

How ’bout them growth projections that done come outta left oilfield?

Revenue growth? A measly 4%.

Earnings growth? Well, that’s going backwards.

Projected Free Cash Flow growth? 64%.

What in tarnation?

I had to scoot over to Texas Instruments’ Investor Relations page and see what was going on. Lucky for a yank like me, they have a whole presentation about it.

Before I could even click, they list right at the top of the page what they’re all about. And dem boys about dem greenbacks.

Ol’ Richy Templeton spells it out: they judge their company by FCF.

What in the blue blazes is FCF, you might ask?

Investopedia says:

Saying it so granny would understand, it’s the money a company brings in from its actual operations MINUS what they are investing in long-term assets.

Lotta finance folk reckon it’s a better metric to go off than earnings because it is clean as a whistle. Net income and earnings per share are the whole kit and caboodle.

Free Cash Flow is whatcha making from whatcha trying to do MINUS how much you’re shelling out on how to do it.

So how much cash they fixin’ to make from selling calculators?

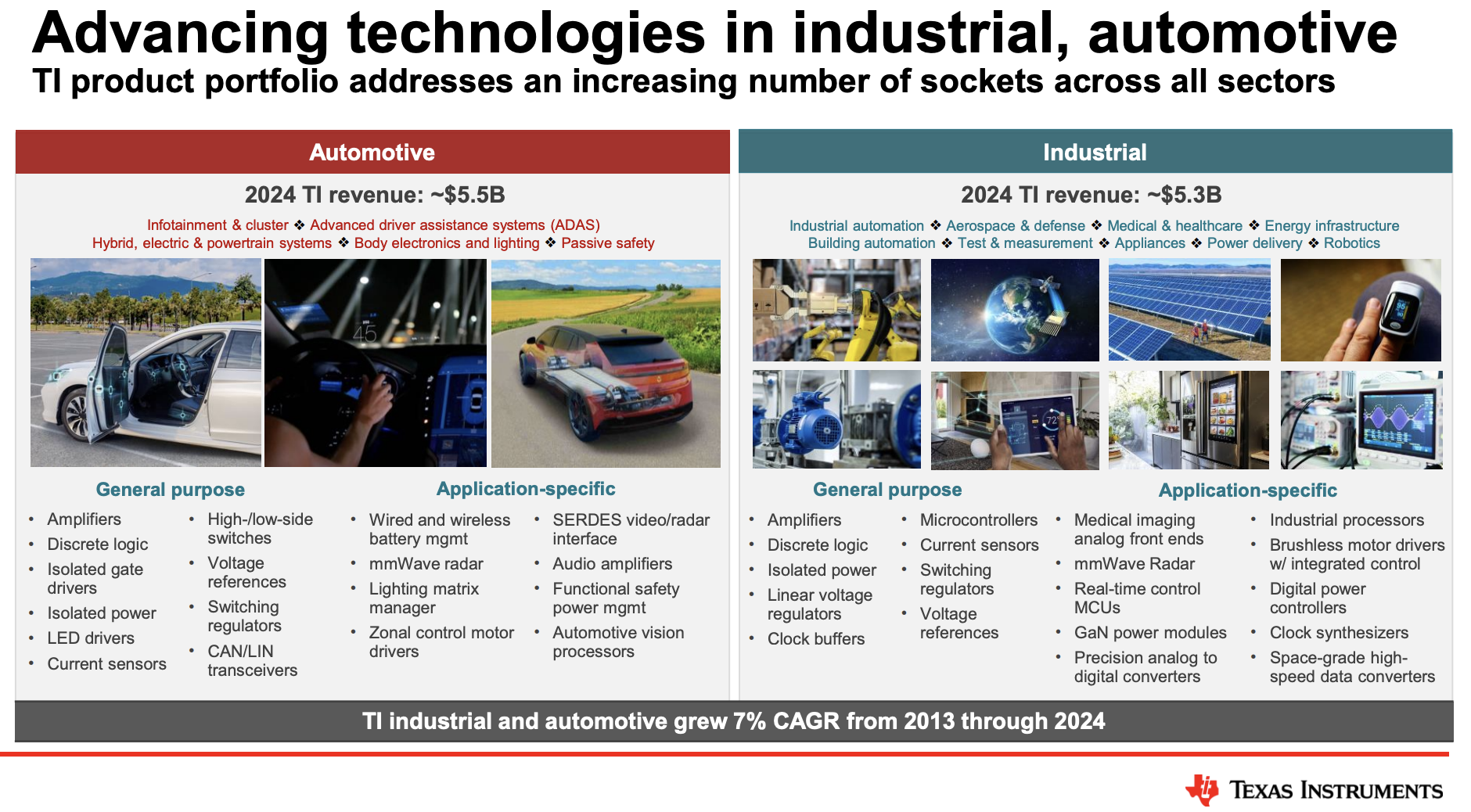

Well, they’re actually a semiconductor company who ain’t betting the whole farm on one crop.

I’m too much of a pea-brained simpleton to really understand how the advanced engineering in the semiconductor industry works.

But I am a pencil-pushing, paper clip–wrangling accountant, so sure, I get this slide:

They are currently investing a lot to bring their chip cost down.

As of February, they are 70% through a six-year elevated investment cycle. But that is coming to an end quicker’n you can holler “supper’s ready,” and that Free Cash Flow the company loves so much is set to shoot up like a weed from 2026 on.

Their low-end estimate for Free Cash Flow per share in 2026 is $8–9 per share. That is the worst they think they will do. The worst estimate they can fetch up would put them…

At the best Free Cash Flow per share the company has ever had.

So even by the low end of their Free Cash Flow per share growth projections, the stock price today looks like it would give market-beating returns over the next five years.

Well, yee-haw.

So here is a thesis so simple even the plainest yokel who’s a couple oats shy of a feedbag can understand:

Buy TXN.

Hold.

And mark your calendars for a few years from now when that ignert Jim Cramer is on CNBC telling you TXN is a great buy after the FCF has already exploded and the stock price has already risen faster than a biscuit in a hot oven.

Bless his heart.

Final Thought

“Don’t go payin’ thoroughbred prices for a mule. Wait ‘til that fine racehorse is standin’ at the discount barn, then back up your truck.” – Warren Buffett, prolly