To UNH or Not To UNH

Welcome to the Schmoozeletter Blog. Your source for weekly water cooler wisecracks from the world of finance. If you have an opinion different than mine or a topic you want to hear about, let me know!

This week, Mr. Market was busy digesting earnings reports and a mixed bag of economic data.

Some tasty treats like juicy GDP growth and mouthwatering numbers from big tech companies like MSFT. Some stale stinkers like higher-than-expected inflation and poor jobs data.

You could say:

The added expense of tariffs is causing an increase in inflation and a slowing of job growth.

This reasonable take, brought to you by how-the-economy-works, is why Fed Chair Powell hasn’t lowered interest rates.

President Trump, to his credit, read the economic data, apologized to Jerome Powell, and is reversing course on his tariff plans.

Just kidding.

Like a fat slob throwing the bathroom scale out the window after a belt-busting Burger King binge session, Trump killed the messenger.

Economic data is a political witch hunt!

Good numbers or no numbers!

Donny scored an 18 at Pebble Beach and anyone who says otherwise will be executed!

Anything to distract from the Epstein list, I guess. But enough mumbo jumbo, this is …

To UNH or Not To UNH

One of the many companies reporting earnings this week was resident healthcare sector scumbags, UnitedHealth Group Incorporated (UNH).

You might remember them as archrival of bushy-eyebrowed dreamboat murderer, Luigi Mangione.

I know some cats who wouldn’t mind getting slayed by that guy if ya know what I mean…

You may think Luigi is a villainous thug who deserves to fry for murdering a loving husband and father in cold blood. You may think Luigi is a champion of the people restoring order to a corrupt system with action instead of whining.

Your portfolio doesn’t really care about your thoughts on that. All your portfolio cares about is: will you get a higher total return on UNH stock than you would in a simple market index fund without taking on sustainably more risk? Your portfolio is asking:

To UNH or Not To UNH

It has been a rough couple of months for the healthcare company.

They got hit with a cyberattack last February:

Then the Department of Justice probed ‘em:

Then Brian Thompson was murdered:

Then they cut their projections for the year:

Then fraud allegations popped up:

And the CEO stepped down:

Then this week they reported earnings which Mr. Market was not impressed with:

All of this has led to a massive sell-off for the company. Now down 60% over the past year:

But how low is too low?

What actually happened in the earnings report?

They grew revenue by nearly 13%.

UNH expects 2025 revenue of at least $446B. That is double-digit revenue growth compared to last year.

And sure, 2025 earnings will be down. But analysts expect steady growth in 2026 and 2027.

Do we really think this company with double-digit revenue growth and growing earnings will be down at a 10 earnings multiple in 2027?

Seems unlikely.

There is also the fact the company is making buckets of cash.

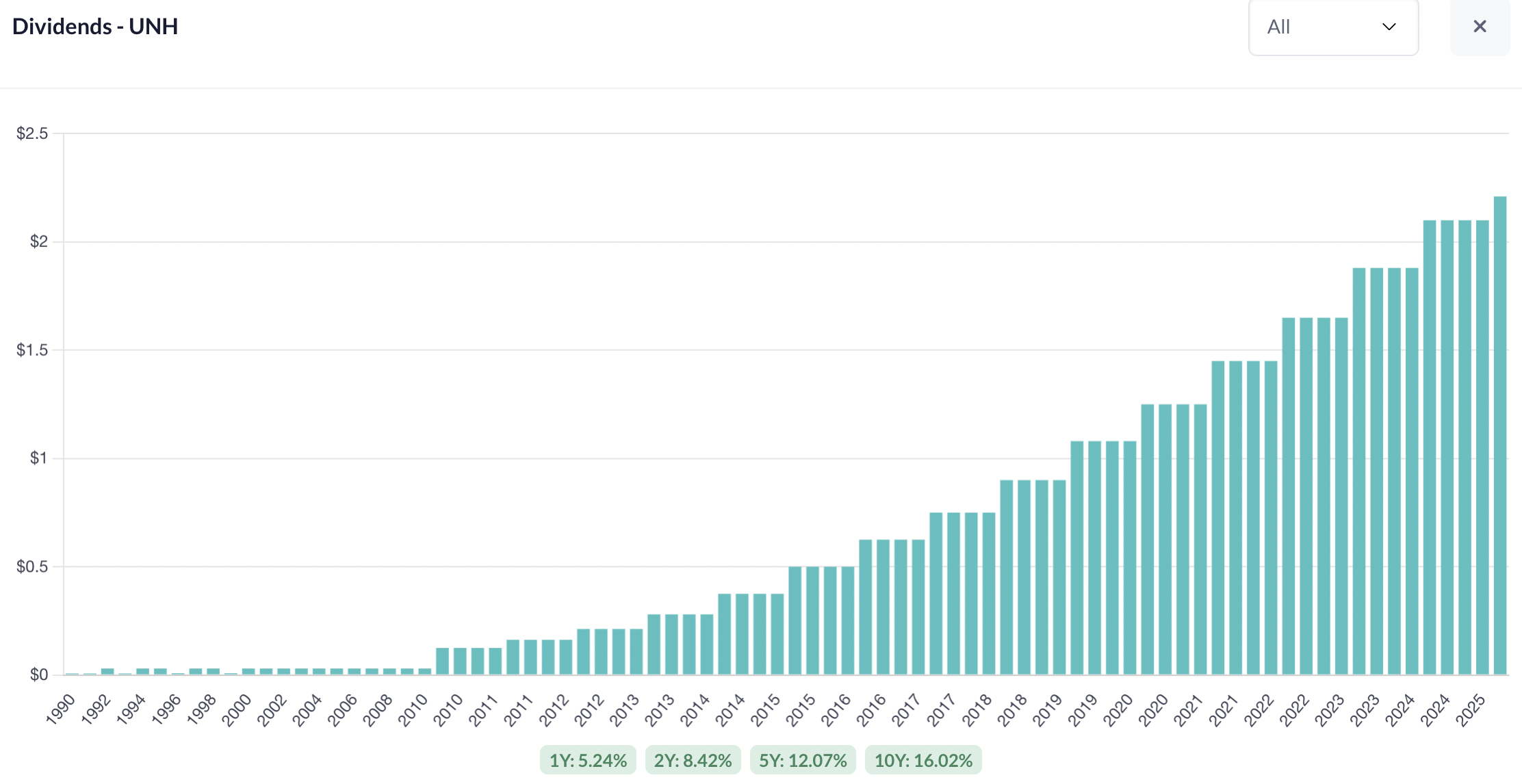

They pay a steady, growing, well-covered dividend.

And they’ve been slowly but steadily buying back shares.

So they return plenty of capital to shareholders.

But a telling aspect when times are tough for a company is to look at what the people inside the doors are doing with their portfolios:

They are buying up tens of millions of dollars’ worth of UNH stock.

Not exactly the actions of executives who are worried about a criminal fraud investigation.

So again we are plagued with:

To UNH or Not To UNH – that is the question:

Whether ’tis nobler in the mind to suffer

Through price swings in hopes of outrageous fortune

Or to lay down our arms to avoid this sea of PR troubles

And by opposing them... To live, to wake –

(I shall write) No more.

Final Thought

"Risk comes from not knowing what you're doing." – Warren Buffett