Prefer Cash? Cash in on Preferreds

Welcome to the Schmoozeletter Blog. Your source for weekly water cooler wisecracks from the world of finance. If you have an opinion different than mine or a topic you want to hear about, let me know!

This week, Mr. Market bounces a bit as the Trump Tariffs Tango continues with a 90-day pause. The CliffNotes version is: 10% tariff on everyone, 25% tariffs on auto imports, 25% on steel and aluminum, 25% tariffs on Mexico and Canada, and like a billion percent or something on China with exceptions for phones, computers, and chips. Got all that?

Honestly, it’s pretty tough to keep track. By the time you are reading this, the policy has probably changed again. All because you fools were too yippy!

Always good when your main economic policy can’t go a full week without tanking the market so hard you need to call it off.

The Wednesday pause announcement sent the market screaming up over 10% in a single day to… almost back where it was last week. And there was some serious money to be made if you knew this was coming.

But insider trading, especially by government officials, is illegal. I’m sure the SEC is going to do a full investigation of anyone in the Trump administration who acted on this information before it became public, and they will be punished to the full extent of the law…

Ninety days isn’t very long, so we’re going to do this all over again pretty soon. But maybe you’re already sick of talking tariffs.

Maybe you just want to know how to make cash now. Maybe you’re JG Wentworth up in here.

You want cash.

You want it paid monthly.

You want 10% on your investment.

And you don’t want to have to wait until there’s a new guy in charge to get it.

Well, Uncle Dave’s got you covered.

Prefer Cash? Cash in on Preferreds

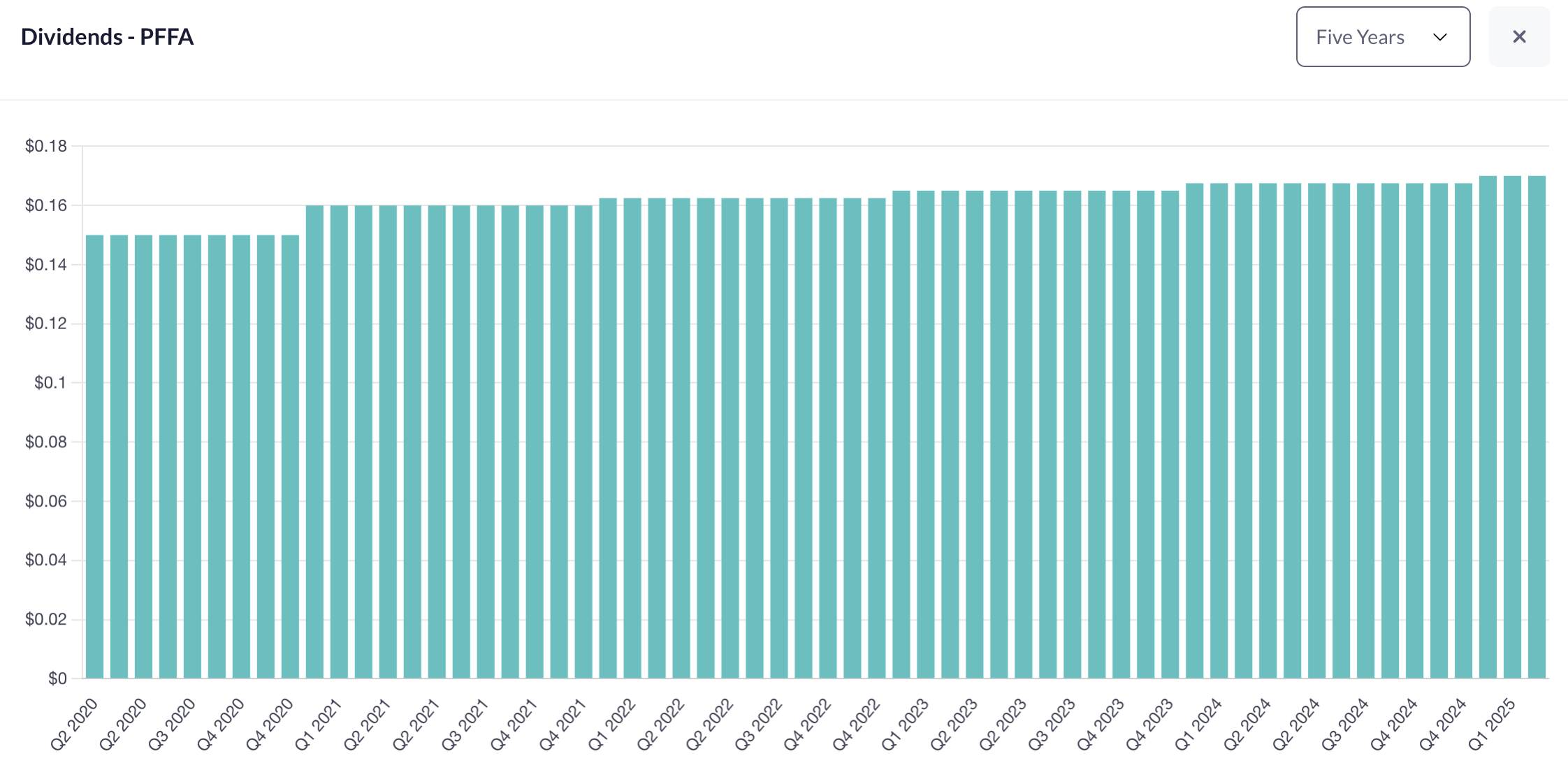

One of the benefits of a market sell-off is that assets become cheaper. The best preferred stock ETF, PFFA, has now sold off to the point where the dividend yield is over 10%.

That means:

If you buy $1,000 of PFFA at this price, it will pay you over $100 in cash over the next year.

If you buy $1M of PFFA at this price, it will pay you over $100K in cash over the next year.

#math

How do you get the cash?

In the form of a nice steady dividend right in your account every single month.

“Hold on, all that sounds great, and I think I prefer preferreds. But what exactly are the preferreds that I prefer?”

Great question.

Preferred stock is a class above the common stock. The benefits are that preferreds function somewhat similar to bonds with steady payments and higher priority in case anything goes wrong.

Preferreds get paid before the lowly common stockholders:

The cons are that preferreds function somewhat similar to bonds with limited price appreciation over the long term. So I hope you don’t prefer the chance for the stock to skyrocket up in price like a tech company could.

PFFA is a fund that is an index of 181 different companies’ preferred stock. They get the dividend payments, take a cut, then pay the rest out to you.

PFFA uses a bit of leverage and may cut their dividend if the entire market were to implode, but those are similar risks with any stock. The biggest negative is the opportunity cost. Over the long term, you would likely do better than a 10% return by just buying and holding a market index fund or the stock of a great company like GOOG or AMZN.

But maybe you prefer the one-in-the-hand vs. two-in-the-bush type play. Maybe you prefer the steady stream of cash every month vs. waiting years to sell. Maybe you prefer 10% in cash vs. 15% in paper gains. If this is you, then maybe you prefer preferreds.

Final Thought

I have a structured in-vest-ment but I NEED CASH NOW. Call PEEEE EFFFF EFFF AHHHH. 877 - Cash - Now.