Fundamentals vs Fluff

Welcome to the Schmoozeletter Blog. Your source for weekly water cooler wisecracks from the world of finance. If you have an opinion different than mine or a topic you want to hear about, let me know!

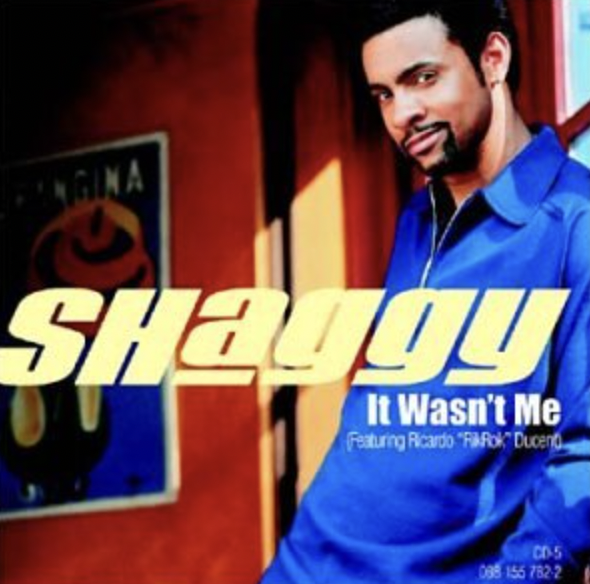

This week, Mr. Market rallies a bit as Trump pulls the Shaggy defense on firing Jerome Powell.

Intention of firing Powell?

But yesterday you were saying…

Looks like the independence of the Fed is safe… for now.

But the major news of the week was the start of quarterly earnings season. And we had two of the big boys reporting their financials for the quarter.

Two companies on very different paths in very different situations.

Two companies with very different management styles and very different leaders.

I’m talking Tesla vs Google in the battle of

Fundamentals vs Fluff

Tesla reported earnings Tuesday and TSLA ended the week up 20% from its pre-earnings closing price.

Alphabet reported earnings Thursday and GOOG ended the week up 1% from its pre-earnings closing price.

The cool thing about the stock market is it is a live auction. It is real money moving around. If a stock rises in price, that’s because people are choosing to buy more of it. The price action is live feedback of public opinion.

So the people have spoken and they looooooooove their TSLA.

We’ll get to the Fundamentals, but first let’s talk about the Fluff:

For TLSA shareholders only two things mattered:

1. Elon said he’s decreasing time in DOGE

2. Elon waxed poetic about the future.

Don’t you know TSLA will be making robots that will print money for the company?

As for what Mr. Market thinks of GOOG, only one thing matters:

1. ChatGPT exists, so Google Search will soon be obsolete.

Don’t you know Google is toast because OpenAI’s tech is gonna knock them out?

If you are like most investors in the market this week, that is all you need to know. That is the narrative and that’s how the majority is applying their capital.

But before we join the herd, let’s take a quick peek at the Fundamentals:

The price:

GOOG is at a 17 forward price-to-earnings ratio. (It’s really cheap.)

TSLA is at a 149 forward price-to-earnings ratio. (It’s really expensive.)

The main driver of revenue:

GOOG Search revenues increased 10% year over year. (That’s good.)

Search is 56% of their total revenues.

TSLA total automotive revenues dropped 20% year over year. (That’s bad.)

Automotive revenue is 72% of their total revenues.

The revenue charts:

GOOG earnings slide deck is 10 slides with handy charts like this:

TSLA earnings slide deck is 32 slides with bullshit photos like this:

The earnings:

GOOG earnings per share of $2.81 increased 49% year over year. (That’s good.)

TSLA earnings per share of $0.12 dropped 71% year over year. (That’s bad.)

The free cash flow:

GOOG free cash flow for the quarter was $19.0B. (That’s more than a billion.)

TSLA free cash flow for the quarter was $0.7B. (That’s less than a billion.)

The dividend plan:

GOOG announced a 5% increase to their cash dividend. (That’s good.)

TSLA does not pay a dividend. (Better hope that price keeps surging.)

The stock buyback plan:

GOOG authorized $70B for share repurchases. (That makes the stock go up.)

TSLA does not buy back shares. (Kinda tough to do with so little money.)

The all-important cybercab

GOOG has an operational cybercab company called Waymo.

Waymo is doing over 250,000 passenger trips per week.

TSLA does not have an operational cybercab company.

Cybercabs “remain on track for volume production next year.” (lol)

The impact of AI:

GOOG Cloud revenues increased 28% year over year to $12.2B. (That’s actual revenue growth.)

TSLA just puts a bunch of words up about rapid growth.

Robots:

GOOG humanoid robot revenues were $0.00 for the quarter.

TSLA humanoid robot revenues were $0.00 for the quarter.

So on the one hand you have a rapidly growing AI-driven tech company that is raking in cash and rewarding shareholders while at a dirt-cheap valuation because investors are scared despite no evidence in their financials of anything to be scared about.

But on the other hand…

Elon Musk.

Now what was it that Elon was most recently projecting?

Give me the Fundamentals over the Fluff all day.

Final Thought

“In the short run, the stock market is a voting machine. But in the long run, it is a weighing machine.” - Benjamin Graham